UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant □

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

JUSHI HOLDINGS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

□Fee paid previously with preliminary materials.

□Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(l) and 0-11.

JUSHI HOLDINGS INC.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS OF JUSHI HOLDINGS INC.

AND

PROXY STATEMENT

FOR ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 4, 2024

April 25, 2024

This Proxy Statement is dated April 25, 2024, and is first being made available to shareholders on or about April 25, 2024.

Jushi Holdings Inc.

Notice of Annual General Meeting of Shareholders (the “Notice”)

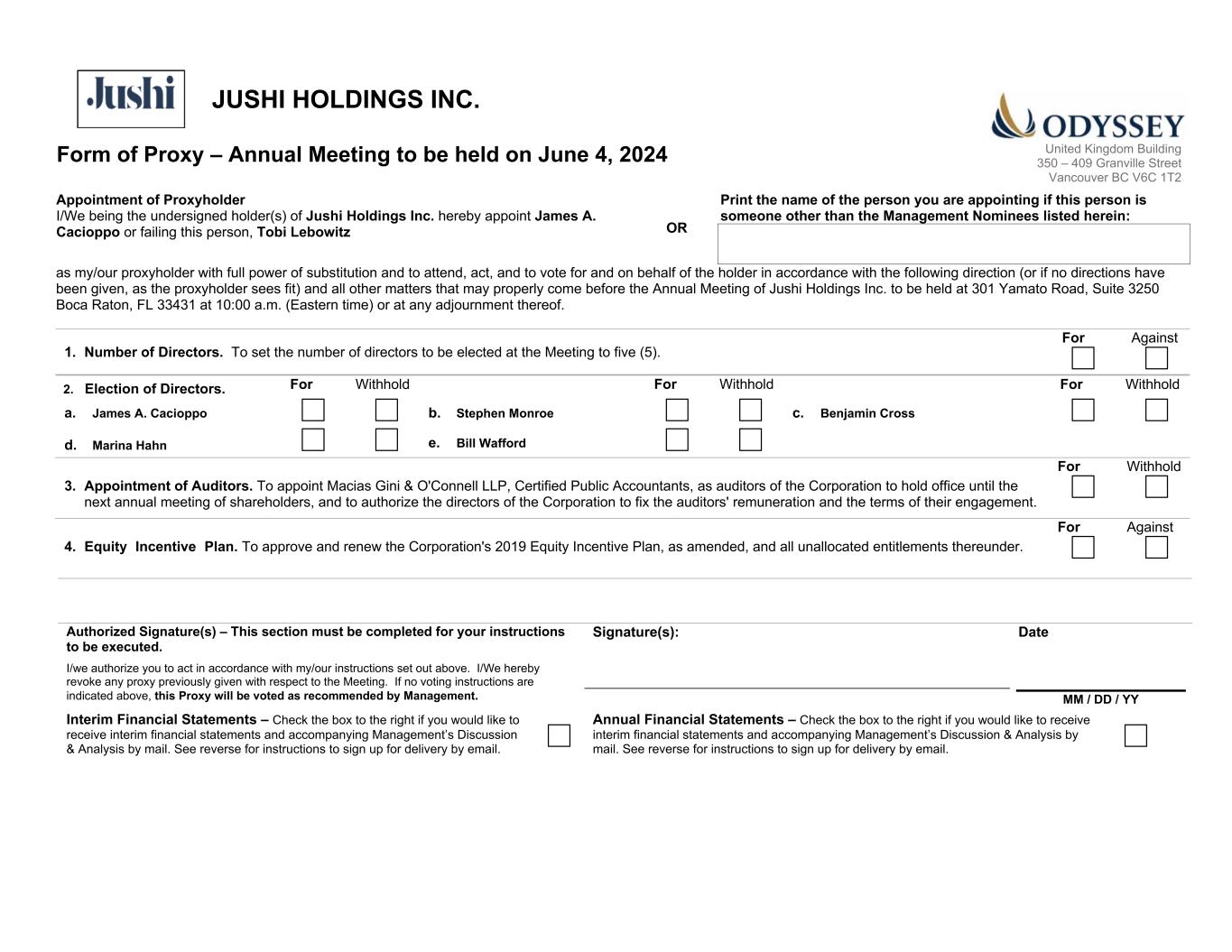

The 2024 annual general meeting of shareholders (the “Meeting”) of Jushi Holdings Inc. (the “Company”), will be a meeting held on June 4, 2024, beginning at 10:00 a.m. (Eastern Time), at the Company's office located at 301 Yamato Road, Suite 3250, Boca Raton, FL 33431.

The following matters will be considered at the Meeting:

•The setting of the number of directors that constitutes the board of directors of the Company (the “Board”) at five;

•The election of five director nominees named in the Proxy Statement to our Board;

•The appointment of Macias Gini & O'Connell LLP as auditors for the Company and the authorization of the Board to fix the auditors' remuneration and set the terms of engagement;

•The approval and renewal of the Company's 2019 Equity Incentive Plan, as amended; and

•The transaction of such other business as may properly come before the meeting or any adjournment, continuance or postponement thereof.

Each of the matters to be acted upon at the meeting are more fully described in our Proxy Statement.

This Notice of Meeting is accompanied by the Proxy Statement and the accompanying form of proxy (“Proxy Instrument”). As permitted by applicable securities law, the Company is using notice-and-access to deliver the Proxy Statement to shareholders. This means that the Proxy Statement is being posted online to access, rather than being mailed out. Notice-and-access substantially reduces the Company's printing and mailing costs and is environmentally friendly as it reduces paper and energy consumption. On or about April 25, 2024, we expect to make the Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2023, including the audited annual consolidated financial statements of the Company, together with the notes thereto and the independent auditor's report and the related management's discussion and analysis contained therein, available on the “Investors” section of the Company's website at https://ir.jushico.com/, SEDAR+ at www.sedarplus.ca and the SEC's website at www.sec.gov. Shareholders will still receive a Proxy Instrument or a voting instruction form in the mail so they can vote their shares, but instead of receiving a paper copy of the Proxy Statement, they will receive a notice with information about how they can access the proxy statement electronically and how to request a paper copy.

The record date for the determination of shareholders of the Company entitled to receive notice of and to vote at the Meeting or any adjournment(s) thereof is April 23, 2024 (the “Record Date”). Shareholders of the Company whose names have been entered in the register of shareholders of the Company at the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting or any adjournment(s) thereof.

A shareholder of the Company may attend the Meeting or may be represented by proxy. Registered shareholders of the Company who are unable to attend the Meeting or any adjournment(s) thereof are requested to date, sign and return the accompanying Proxy Instrument for use at the Meeting or any adjournment(s) thereof.

To be effective, the Proxy Instrument must be returned to Odyssey, the Corporation's transfer agent at Odyssey Trust Company, 702 – 67 Yonge Street, Toronto, ON, M5E 1J8. Alternatively, you may vote by Internet at https://login.odysseytrust.com/pxlogin. All instructions are listed on the Proxy Instrument. Your proxy or voting instructions must be received in each case no later than 10:00 a.m. (Eastern Time) on May 31, 2024 or, if the Meeting is adjourned, at least 48 hours (excluding Saturdays, Sundays and statutory holidays in the Province of British Columbia) before the beginning of any adjournment(s) or postponement of the Meeting.

Whether or not you plan to attend the Meeting, we encourage you to read this Proxy Statement and promptly vote your shares. For specific instructions on how to vote your shares, please refer to the section entitled “ How You Can Vote” and to the instructions on your proxy or voting instruction card.

DATED as of April 25, 2024

By Order of the Board of Directors

/s/ Tobi Lebowitz

Tobi Lebowitz

Chief Legal Officer and Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 4, 2024.

Notice of Annual General Meeting and Proxy Statement are available online at the “Investors” section of our website at https://ir.jushico.com/corporate-governance/annual-meeting. The 2023 Annual Report to Shareholders, which includes our Form 10-K for the year ended December 31, 2023, is also available online at the “Investors” section of our website at https://ir.jushico.com/.

YOUR VOTE IS IMPORTANT, PLEASE VOTE YOUR PROXY OVER THE INTERNET BY VISITING LOGIN.ODYSSEYTRUST.COM/PXLOGIN OR MARK, SIGN, DATE AND RETURN YOUR PROXY INSTRUMENT BY MAIL WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL GENERAL MEETING OF SHAREHOLDERS.

PROXY STATEMENT FOR THE 2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON

JUNE 4, 2024

This Proxy Statement (this “Proxy Statement”) contains information about the 2024 annual general meeting of shareholders (the “Meeting”) of Jushi Holdings Inc., to be held on June 4, 2024, beginning at 10:00 a.m. (Eastern Time) at 301 Yamato Road, Suite 3250, Boca Raton, FL 33431. The board of directors (the “board of directors” or the “Board”) is using this Proxy Statement to solicit proxies for use at the Meeting. Unless the context otherwise requires, references to “we,” “us,” “our,” “Company” or “Jushi” or similar terms refers to Jushi Holdings Inc. together with its wholly-owned subsidiaries. The mailing address of our principal executive offices is 301 Yamato Road, Suite 3250, Boca Raton, FL 33431.

All properly submitted proxies will be voted in accordance with the instructions contained in those proxies. If no instructions are specified, the proxies will be voted in accordance with the recommendation of our Board with respect to each of the matters set forth in the accompanying Notice of Meeting (the “Notice”). You may revoke your proxy at any time up to and including the last business day preceding the day of the Meeting by (i) giving our Corporate Secretary written notice to that effect or (ii) at the Meeting by providing written notice to our Corporate Secretary to that effect.

We first made this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 available to shareholders on April 25, 2024.

We are an “emerging growth company” under applicable U.S. federal securities laws and therefore permitted to conform with certain reduced public company reporting requirements. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the U.S. Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may take advantage of these exemptions until the last day of the fiscal year in which the fifth anniversary of our initial public offering occurs (December 31, 2027) or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.235 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the U.S. Securities and Exchange Commission (the “SEC”) or if we issue more than $1.0 billion of non-convertible debt over a three-year period.

We are also a “smaller reporting company” under applicable U.S. federal securities laws. We will remain a smaller reporting company so long as either (i) the market value of shares of our common stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of shares of our common stock held by non-affiliates is less than $700 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company we may choose to present reduced disclosures regarding executive compensation.

Important Notice Regarding the Availability of Proxy Materials for the Annual General

Meeting of Shareholders to be Held on June 4, 2024:

This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are available for viewing, printing and downloading at https://ir.jushico.com/.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the SEC on April 1, 2024, except for exhibits, will be furnished without charge to any shareholder upon written request to Investor Relations at investors@jushico.com. This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are also available on the “Investors” section of our website at https://ir.jushico.com/, the SEC's website at www.sec.gov and SEDAR+ at www.sedarplus.ca.

Table of Contents

GENERAL INFORMATION ABOUT THE ANNUAL GENERAL MEETING AND VOTING

Proxy Materials

Why am I receiving these materials?

Our Board is using this Proxy Statement to solicit proxies for use at the Meeting, and at any adjournments, continuances, or postponements of the Meeting. The Meeting will be held on June 4, 2024, at 301 Yamato Road, Suite 3250, Boca Raton, FL 33431. The Company is making these materials available to shareholders by posting them online to access, rather than mailing them out unless specifically requested by a shareholder. The cost of any solicitation will be borne by the Company. Proxies may also be solicited personally by employees of the Company at nominal cost to the Company.

As a shareholder as of the Record Date, you are invited to attend the Meeting and are entitled and requested to vote on the business items described in this Proxy Statement. This Proxy Statement is furnished in connection with the solicitation of proxies by or on behalf of management of the Company and the Board. This Proxy Statement is designed to assist you in voting your shares and includes information that we are required to provide under the rules of the SEC and applicable Canadian securities laws.

These proxy materials are being sent to both registered and Non-registered Shareholders (as defined below). In some instances, the Company has distributed copies of the Notice, the Proxy Statement and the accompanying Proxy Instrument (collectively, the “Documents”) to clearing agencies, securities dealers, banks and trust companies, or their nominees (collectively “Intermediaries,” and each an “Intermediary”) for onward distribution to shareholders whose shares are held by or in the custody of those Intermediaries (“Non-registered Shareholders”). The Intermediaries are required to forward the Documents to Non-registered Shareholders.

Solicitation of proxies from Non-registered Shareholders will be carried out by Intermediaries, or by the Company if the names and addresses of Non-registered Shareholders are provided by the Intermediaries.

Non-registered Shareholders who have received the Documents from their Intermediary should follow the directions of their Intermediary with respect to the procedure to be followed for voting at the Meeting. Generally, Non-registered Shareholders will either:

•receive a form of proxy executed by the Intermediary but otherwise uncompleted. The Non-registered Shareholder may complete the proxy and return it directly to the Intermediary; or

•be provided with a request for voting instructions. The Intermediary is required to send the Company an executed form of proxy completed in accordance with any voting instructions received by the Intermediary.

If you are a Non-registered Shareholder, and the Company or its agent has sent these materials directly to you, your name and address and information about your holdings of securities have been obtained from your Intermediary in accordance with applicable securities regulatory requirements. By choosing to send the Documents to you directly, the Company (and not your Intermediary) has assumed responsibility for: (i) delivering the Documents to you; and (ii) executing your proper voting instructions. Non-registered Shareholders who have elected to receive the Documents by electronic delivery (“e-Delivery”) will have received e-mail notification from the Intermediary that the Documents are available electronically on the Company's website. Please return your voting instructions as specified in the request for voting instructions.

What is included in the proxy materials?

The proxy materials include:

•our Notice of Meeting;

•our Proxy Statement for the Meeting;

•a Proxy Instrument or voting instruction card;

•The approval and renewal of the Company's 2019 Equity Incentive Plan, as amended; and

•our 2023 Annual Report on Form 10-K.

What information is contained in this proxy statement?

The information in this Proxy Statement relates to the proposals to be voted on at the Meeting, the voting process, our Board and board committees, corporate governance, the compensation of our directors and executive officers and other required information.

I share an address with another shareholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy?

If you share an address with another shareholder, you may receive only one set of proxy materials unless you have provided contrary instructions. If you wish to receive a separate set of the proxy materials, please request the additional copy by contacting Investor Relations at investors@jushico.com or by calling us at (561) 617-9100.

A separate set of the materials will be sent promptly following receipt of your request.

If you are a beneficial owner of shares and you wish to receive a separate set of proxy materials in the future, or if you have received multiple sets of proxy materials and would like to receive only one set in the future, please contact your bank or broker directly.

Shareholders also may write to, or email us, at the address below to request a separate copy of the proxy materials:

Jushi Holdings Inc.

Attn: Investor Relations

301 Yamato Road, Suite 3250

Boca Raton, FL 33431

investors@jushico.com

Who pays the cost of soliciting proxies for the Meeting?

We will bear the cost of solicitation. This solicitation of proxies is being made to shareholders by mail, but may be supplemented by telephone or other personal contact.

We will not reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy materials to beneficial shareholders.

What items of business will be voted on at the Meeting?

The business items to be voted on at the Meeting are:

•The setting of the number of directors that constitutes the Board at five;

•The election of five directors for the forthcoming year from the nominees proposed by the Board;

•The appointment of Macias Gini & O'Connell LLP, as auditors for the Company and the authorization of the Board to fix the auditors' remuneration and set the terms of engagement;

•The approval and renewal of the Company's 2019 Equity Incentive Plan, as amended; and

•The transaction of such other business as may properly come before the Meeting or any adjournment(s) thereof.

What are my voting choices?

You may vote “FOR” or “AGAINST” for the setting of the number of directors that constitutes the Board at five; “FOR” or “WITHHOLD” for the election of nominees for election as directors; “FOR” or “WITHHOLD” for the appointment of Macias Gini & O'Connell LLP as auditors for the ensuing year and the authorization of the Board to fix the auditor’s remuneration and set the terms of engagement; and “FOR” or “AGAINST” for the approval and renewal of the Company's 2019 Equity Incentive Plan, as amended.

How does the Board recommend that I vote?

Our Board recommends that you vote your shares “FOR” the setting of the number of directors that constitutes the Board at five; “FOR” each of the Company's nominees for election to the Board; “FOR” the appointment of Macias Gini & O'Connell LLP, as

auditors for the ensuing year and the authorization of the Board to fix the auditor’s remuneration and set the terms of engagement; and “FOR” the approval and renewal of the Company's 2019 Equity Incentive Plan, as amended.

What vote is required to approve each item?

To conduct business at the Meeting, the quorum of shareholders is two (2) persons who are, or who represent by proxy, shareholders holding, in the aggregate, at least 5% of the issued shares entitled to be voted at the Meeting.

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “FOR,” “AGAINST,” “WITHHOLD,” votes and broker non-votes. A “broker non-vote” occurs when your broker submits a proxy card for your subordinate voting shares held in street name, but does not vote on a particular proposal because the broker has not received voting instructions from you and does not have the authority to vote on that matter without instructions. Under the rules that govern brokers who are voting shares held in street name, brokers have the discretion to vote those shares on routine matters but not on non-routine matters. For purposes of these rules, the only routine matter in this Proxy Statement is Proposal Three—appointment of Macias Gini & O'Connell LLP, as auditors for the Company and the authorization of the Board to fix the auditors’ remuneration and set the terms of engagement. Proposals One, Two and Four are non-routine matters. Therefore, if you hold your shares in street name and do not provide voting instructions to your broker, your broker does not have discretion to vote your shares on any proposal at the Meeting other than Proposal Three—appointment of Macias Gini & O'Connell LLP, as auditors for the Company and the authorization of the Board to fix the auditors’ remuneration and terms of engagement. However, your shares will be considered present at the Meeting for purposes of determining the existence of a quorum.

Proposal 1—Setting of the Number of Directors that Constitutes the Board

The setting of the number of directors that constitutes the Board requires the affirmative vote of a majority of the of the votes properly cast “FOR” or “AGAINST” this proposal. Abstentions and Broker non-votes will have no effect on the results of this vote. Brokers do not have discretionary authority to vote uninstructed shares on this proposal.

Proposal 2—Election of Directors

The election of the director nominees requires a plurality vote of the shares present in person or represented by proxy at the Meeting and entitled to vote on the election of directors. The director nominees receiving the highest number of “FOR” votes cast by the holders of subordinate voting shares, entitled to vote at the Meeting, and in any case at least one FOR vote, will be elected. Accordingly, “WITHHOLD” votes and broker non-votes will have no effect on the outcome of the election of directors. Brokers do not have discretionary authority to vote uninstructed shares on this proposal. Shareholders have no right to cumulative voting as to any matters, including the election of directors.

Proposal 3—Appointment of Macias Gini & O'Connell LLP, as auditors for the Company and the authorization of the Board to fix the auditors’ remuneration and set the terms of engagement

The proposal to ratify the appointment of Macias Gini & O’Connell LLP requires the affirmative vote of a majority of the votes properly cast “FOR” this proposal. Abstentions and Broker non-votes will have no effect on the results of this vote. Brokers have discretionary authority to vote uninstructed shares on this proposal.

Proposal 4—Approval and Renewal of the Company's 2019 Equity Incentive Plan, as amended

The approval and renewal of the Company's 2019 Equity Incentive Plan, as amended, requires the affirmative vote of a majority of the of the votes properly cast “FOR” or “AGAINST” this proposal. Abstentions and Broker non-votes will have no effect on the results of this vote. Brokers do not have discretionary authority to vote uninstructed shares on this proposal.

If you indicate “WITHHOLD” in respect to the election of directors or the appointment of the auditor and the authorization of the Board to fix the auditors’ remuneration and set the terms of engagement, your vote will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Meeting. As described below, broker non-votes will be counted for determining the presence or absence of a quorum for the transaction of business at the Meeting, but will not be considered votes cast with respect to the election of any director nominee or on any other proposal.

What happens if additional items are presented at the Meeting?

As of the date of this Proxy Statement, management of the Company knows of no such amendments, variations or other matters to come before the Meeting. However, if other matters properly come before the Meeting, it is the intention of the persons named in the enclosed Proxy Instrument to vote such shares for which they hold a proxy according to their best judgment.

Where can I find the voting results?

We expect to announce preliminary voting results at the Meeting and to publish final results in a current report on Form 8-K that we will file with the SEC and in a press release that we will file in Canada on SEDAR+ promptly following the Meeting. Both the Form 8-K and press release will also be available on the “Investors” section of our website at https://ir.jushico.com/.

How You Can Vote

What shares can I vote?

If you were a holder of record of the Company's subordinate voting shares on April 23, 2024, the Record Date for the Meeting, you are entitled to vote all shares owned by you as of such date at the Meeting, including (1) shares held directly in your name as the shareholder of record and (2) shares held for you as the beneficial owner through a bank, broker or other nominee. On April 23, 2024, there were 231 shareholders of record holding 196,634,931 outstanding subordinate voting shares.

REGISTERED SHAREHOLDERS HAVE THE RIGHT TO APPOINT A PERSON TO REPRESENT HIM, HER OR IT AT THE MEETING OTHER THAN THE PERSON(S) DESIGNATED IN THE PROXY INSTRUMENT either by striking out the names of the persons designated in the Proxy Instrument and by inserting the name of the person or company to be appointed in the space provided in the Proxy Instrument or by completing another proper form of proxy and, in either case, delivering the completed proxy by mail to Odyssey Trust Company, 702 – 67 Yonge Street, Toronto, ON, M5E 1J8. Alternatively, you may vote by Internet at https://login.odysseytrust.com/pxlogin.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Most of our shareholders hold their shares through a bank, broker or other nominee rather than having the shares registered directly in their own name. Summarized below are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record

If the shares held by you as of the Record Date are registered directly in your name with our transfer agent, Odyssey Trust Company, you are the shareholder of record of the shares. As the shareholder of record, you have the right to grant a proxy to vote such shares to representatives from the Company or to another person, or to vote your shares at the Meeting. You have received a Proxy Instrument to use in voting such shares either by mail or email.

Beneficial Owner

If the shares held by you as of the Record Date are held through a bank, broker or other nominee, it is likely that they are registered in the name of the nominee and you are the beneficial owner of shares held in street name.

As the beneficial owner of shares held for your account, you have the right to direct the registered holder to vote such shares as you instruct, and you also are invited to attend the Meeting. Your bank, broker, plan trustee or other nominee has provided a voting instruction card for you to use in directing how your shares are to be voted.

How can I attend the Meeting?

The Meeting will be held at 301 Yamato Road, Suite 3250, Boca Raton, FL 33431 on Tuesday, June 4, 2024 at 10:00 a.m. (Eastern time). All shareholders are cordially invited to attend the annual meeting.

How can I vote at the Meeting?

If a shareholder attends the Meeting and is a registered shareholder, the shareholder may cast his, her or its vote(s) for each of his, her or its registered subordinate voting shares held as of the Record Date on any and all resolutions placed before the Meeting. If a shareholder does not wish to vote for any matter proposed at the Meeting, the shareholder may withhold his, her or its vote from, or vote his, her or its subordinate voting shares held as of the Record Date against, as applicable, any resolution at the Meeting, depending on the specific resolution. If a shareholder attends the Meeting in person and is a beneficial shareholder, that shareholder will not be entitled to vote at the Meeting unless he, she or it contacts his, her or its intermediary well in advance of the Meeting and carefully follows its instructions and procedures. Even if you plan to attend the Meeting, we recommend that you also submit your proxy or voting instructions as described below, so that your vote will be counted if you later decide not to attend.

How can I vote without attending the Meeting?

Whether you hold the shares held by you as of the Record Date as a shareholder of record or as a beneficial owner, you may direct how such shares are to be voted without attending the Meeting or any adjournment(s) or postponement(s) thereof. If you are a shareholder of record, you may vote by submitting a proxy. If you hold shares as of the Record Date as a beneficial owner, you may vote by submitting voting instructions to the registered owner of such shares. Each registered shareholder submitting a proxy has the right to appoint one or more proxy holders (but not more than five) to represent the shareholder at the Meeting to the extent and with the powers conferred by the proxy.

For directions on how to vote, please refer to the following instructions and those included on your proxy or voting instruction card. A proxy form will not be valid unless completed and deposited in accordance with the instructions set out in the proxy form.

Voting by Internet

Shareholders may vote over the Internet by following the instructions on the Proxy Instrument or voting instruction card.

Voting by Mail

Shareholders may vote by mail by signing, dating and returning their Proxy Instrument or voting instruction card to the following address:

Odyssey Trust Company

702 – 67 Yonge Street

Toronto, ON, M5E 1J8

How do I submit questions or comments for the Meeting?

We do not plan to take questions or comments during the Meeting. Shareholders may direct communications to the Company outside of the Meeting at our principal executive offices. The mailing address of our principal executive offices is 301 Yamato Road, Suite 3250, Boca Raton, FL 33431.

How will my shares be voted?

Shares held as of the Record Date represented by properly executed proxies in favor of persons designated in the printed portion of the enclosed Proxy Instrument WILL, UNLESS OTHERWISE INDICATED, BE VOTED FOR THE SETTING OF THE NUMBER OF DIRECTORS AT FIVE, FOR ELECTION OF DIRECTORS, FOR THE APPOINTMENT OF MACIAS GINI & O'CONNELL LLP, AS THE AUDITORS OF THE COMPANY AND FOR THE AUTHORIZATION OF THE BOARD OF DIRECTORS TO FIX AUDITORS' REMUNERATION AND TERMS OF ENGAGEMENT, AND FOR THE APPROVAL AND RENEWAL OF THE COMPANY'S 2019 EQUITY INCENTIVE PLAN, AS AMENDED. The shares held as of the Record Date represented by the Proxy Instrument will be voted or withheld from voting in accordance with the instructions of the shareholder on any ballot that may be called for and, if the shareholder specifies a choice with respect to any matter to be acted upon, the shares will be voted accordingly. The enclosed Proxy Instrument confers discretionary authority on the persons named therein with respect to amendments or variations to matters identified in the Notice or other matters which may properly come before the Meeting. As of the date of this Proxy Statement, management of the Company knows of no such amendments, variations or other matters to come before the Meeting. However, if other matters properly come before the Meeting, it is the intention of the persons named in the enclosed Proxy Instrument to vote such shares for which they hold a proxy according to their best judgment.

Will shares I hold in my brokerage account be voted if I do not provide timely voting instructions?

If shares held by you as of the Record Date are held through a brokerage firm, they will be voted as you instruct on the voting instruction card provided by your broker. If you sign and return your card without giving specific instructions, such shares will be voted in accordance with the recommendations of our Board.

If you do not return your voting instruction card on a timely basis, your broker will have the authority to vote such shares only on the proposal to ratify our independent registered public accounting firm. Your broker will be prohibited from voting such shares without your instructions on the election of directors and on any other proposal. These “broker non-votes” will be counted only for the purpose of determining whether a quorum is present at the Meeting and not as votes cast. Such broker non-votes will have no effect on the outcome of the matters to be voted on at the Meeting.

Will shares that I own as a shareholder of record be voted if I do not timely return my proxy card?

Shares that you own as a shareholder of record as of the Record Date will be voted as you instruct on your Proxy Instrument or voting instruction card. If you sign and return your proxy card without giving specific instructions, they will be voted in accordance with the procedure set out above under the heading “How will my shares be voted?”

If you do not timely return your Proxy Instrument or voting instruction card, your shares will not be voted unless you or your proxy holder attends the Meeting and any adjournment(s) or postponement(s) thereof and votes submitted during the Meeting as described above under the heading “How can I vote at the Meeting?”

When is the deadline to vote?

If you hold shares as of the Record Date as the shareholder of record, your vote by proxy must be received before 10:00 a.m. (Eastern Time) on May 31, 2024 or 48 hours prior to any adjournment(s) of the Meeting or must be deposited at the Meeting with the chairman of the Meeting before the commencement of the Meeting or any adjournment(s) thereof.

If you hold shares as of the Record Date as a beneficial owner, please follow the voting instructions provided by your bank, broker or other nominee.

May I change or revoke my vote?

•A shareholder who has given a proxy pursuant to this solicitation may revoke it at any time up to and including the last business day preceding the day of the Meeting or any adjournment(s) thereof at which the proxy is to be used:

•by an instrument in writing executed by the Shareholder or by his, her or its attorney authorized in writing and delivered to the attention of Odyssey Trust Company, 702 – 67 Yonge Street, Toronto, ON, M5E 1J8;

•by delivering written notice of such revocation to the chairman of the Meeting prior to the commencement of the Meeting on the day of the Meeting or any adjournment(s) thereof, or

•in any other manner permitted by law.

For shares you hold as of the Record Date as a beneficial owner, you may change your vote by timely submitting new voting instructions to your bank, broker or other nominee (which revokes your earlier instructions), or, if you have obtained a legal proxy from the nominee giving you the right to vote your shares held as of the Record Date, by attending the Meeting and voting such shares.

Shareholder Proposals and Director Nominations

What is the deadline to submit shareholder proposals to be included in the proxy materials for next year's annual meeting?

The Company is subject to the rules of both the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and provisions of the Business Corporations Act (British Columbia) (“BCBCA”) with respect to shareholder proposals. As clearly indicated under the BCBCA and SEC rules under the Exchange Act, simply submitting a shareholder proposal does not guarantee its inclusion in the proxy materials.

Shareholder proposals submitted pursuant to SEC rules under the Exchange Act for inclusion in the Company's proxy materials for next year's annual meeting must be received by our Corporate Secretary no later than the close of business (Eastern time) on December 26, 2024 and must be submitted to our Corporate Secretary at Jushi Holdings Inc., 301 Yamato Road, Suite 3250, Boca Raton, FL 33431. Such proposals must also comply with all applicable provisions of Rule 14a-8 under the Exchange Act.

The BCBCA also sets out the requirements for a valid proposal and provides for the rights and obligations of the Company and the submitter upon a valid proposal being made. Proposals submitted under the applicable provisions of the BCBCA that a shareholder intends to present at next year's annual meeting and wishes to be considered for inclusion in the Company's Proxy Statement and form of proxy relating to next year's annual meeting must be received at least three (3) months before the anniversary of the Company's last annual general meeting (i.e. by March 4, 2025). Such proposals must also comply with all applicable provisions of the BCBCA and the regulations thereunder.

Proposals that are not timely submitted or are submitted to the incorrect address or other than to the attention of our Corporate Secretary may, at our discretion, be excluded from our proxy materials.

See below under the heading “How may I nominate director candidates or present other business for consideration at a meeting?” for a description of the procedures through which shareholders may nominate director candidates for consideration.

How may I nominate director candidates or present other business for consideration at a meeting?

Shareholders who wish to (1) submit director nominees for consideration or (2) present other items of business directly at next year's annual meeting must give written notice of their intention to do so, in accordance with the deadlines described below, to our Corporate Secretary at the address set forth below under the heading “How do I obtain additional copies of this Proxy Statement or voting materials?” Any such notice also must include the information required by our Articles of Incorporation (as amended to date, the “Articles”) (which may be obtained as provided below under the heading “How may I obtain financial and other information about Jushi Holdings Inc.?”) and must be updated and supplemented as provided in the Articles.

Written notice of director nominees must be received, in the case of an annual meeting, not less than thirty (30) days prior to the date of the annual meeting of shareholders; provided, however, that if the annual meeting of shareholders is to be held on a date that is less than fifty (50) days after the date on which the initial public announcement of the date of the annual meeting of shareholders was made, notice by the nominating shareholder may be made not later than the close of business on the tenth (10th) day following such public announcement. In addition, in order to comply with universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company's nominees must provide a notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than April 5, 2025.

How may I recommend candidates to serve as directors?

Shareholders may recommend director candidates for consideration by the Board by writing to our Corporate Secretary at the address set forth below under the heading “How do I obtain additional copies of this Proxy Statement or voting materials?” in accordance with the notice provisions described above under the heading “How may I nominate director candidates or present other business for consideration at a meeting?”

To be in proper written form, such notice must set forth the nominee's name, age, business and residential address, and principal occupation or employment for the past five (5) years, his or her direct or indirect beneficial ownership in, or control or direction over, any class or series of securities of the Company, including the number or principal amount and such other information on the nominee and the nominating shareholder as set forth in our Articles, which may be obtained in accordance with the instructions below under the heading “How may I obtain financial and other information about Jushi Holdings Inc.?”

Description of the Company's Voting Securities

The Company is authorized to issue an unlimited number of subordinate voting shares, an unlimited number of multiple voting shares, an unlimited number of super voting shares and an unlimited number of preferred shares.

On April 23, 2024, there were 231 shareholders of record holding 196,634,931 outstanding subordinate voting shares. There were no shareholders holding any multiple voting shares, super voting shares or preferred shares.

The subordinate voting shares, multiple voting shares and preferred shares are “restricted securities” within the meaning of such term under applicable Canadian securities laws. Under Canadian securities laws, a “restricted security” means an equity security of a reporting issuer if, among other things, there is another class of securities of the reporting issuer that carries a greater number of votes per security relative to the equity security. As of April 23, 2024, the subordinate voting shares represent 100% of voting rights attached to outstanding securities of the Company, and the multiple voting shares, super voting shares and preferred shares collectively represent 0% of voting rights attached to outstanding securities of the Company.

As of April 23, 2024, the total number of subordinate voting shares of the company outstanding assuming all outstanding options and warrants are exercised is 314,206,508.

Holders of subordinate voting shares held as of the Record Date are entitled to notice of and to attend at any meeting of the shareholders of the Company, except a meeting of which only holders of another particular class or series of shares of the Company have the right to vote. At each such meeting, holders of subordinate voting shares are entitled to one vote in respect of each subordinate voting share held.

Notice-and-Access

The Company is using the “Notice-and-Access” provisions of applicable securities laws under Rule 14a-16 under the Exchange Act. Under notice-and-access, companies may post electronic versions of such materials on a website for investor access and review and will make such documents available in hard copy upon request at no cost. Notice-and-access substantially reduces the Company's printing and mailing costs and is environmentally friendly as it reduces paper and energy consumption. The Proxy Statement, the Annual Report on Form 10-K for the fiscal year ended December 31, 2023, together with the notes thereto and the independent auditor's report thereon and the related management's discussion and analysis are available on the “Investors” section of our website at https://ir.jushico.com/, SEDAR+ at www.sedarplus.ca and the SEC's website at www.sec.gov. The Company has elected not to use the procedure known as “stratification” in relation to its use of the “Notice-and-Access rules”.

Obtaining Additional Information

How may I obtain financial and other information about Jushi Holdings Inc.?

Our consolidated financial statements are included in our Annual Report on Form 10-K. We filed our Annual Report on Form 10-K with the SEC on April 1, 2024. We will furnish a copy of our Annual Report on Form 10-K (excluding exhibits, except those that are specifically requested) without charge to any shareholder who so requests by writing to our Investor Relations Department at the address below under the heading in “How do I obtain additional copies of this Proxy Statement or voting materials?” The Annual Report on Form 10-K is also available free of charge on the “Investors” section of our website at https://ir.jushico.com/, on the SEC's website at www.sec.gov, and on SEDAR+ at www.sedarplus.ca.

By writing to us, shareholders also may obtain, without charge, a copy of our Articles, code of conduct and Board standing committee charters.

What if I have questions for the Company's transfer agent?

If you are a shareholder of record and have questions concerning share certificates, ownership transfer or other matters relating to your share account, please contact our transfer agent at the following address:

Odyssey Trust Company

702 – 67 Yonge Street

Toronto, ON, M5E 1J8

How do I obtain additional copies of this Proxy Statement or voting materials?

If you need additional copies of this Proxy Statement or voting materials, please contact us at:

Jushi Holdings Inc.

Attn: Corporate Secretary

301 Yamato Road, Suite 3250

Boca Raton, FL 33431

investors@jushico.com.

OVERVIEW OF PROPOSALS TO BE VOTED ON

Proposals 1, 2, 3 and 4 are included in this Proxy Statement at the direction of our Board. Our Board unanimously recommends that you vote “FOR” setting the number of directors that constitutes the Board at five in Proposal 1, “FOR” the election of the five director nominees in Proposal 2, “FOR” the appointment and remuneration of auditors in Proposal 3, and “FOR” the approval and renewal of the 2019 Equity Incentive Plan in Proposal 4.

PROPOSAL 1 - SETTING OF THE NUMBER OF DIRECTORS THAT CONSTITUTES THE BOARD

Our Articles provide that the number of directors should not be fewer than three (3) directors. There are currently five (5) directors of the Company. At the Meeting, it is proposed to fix the number of directors that constitutes the Board at five (5). Approval of this proposal requires the receipt of “FOR” votes constituting a majority of the shares cast by the shareholders who vote in respect of this proposal.

The persons named in the accompanying Proxy Instrument (if named and absent contrary directions) intend to vote the shares represented thereby “FOR” setting the number of directors at five unless otherwise instructed on a properly executed and validly deposited proxy.

PROPOSAL 2 - ELECTION OF DIRECTORS

Directors are elected annually to one-year terms and each director nominee has consented to being named in this Proxy Statement and has agreed to serve if elected. The Board proposes to nominate at the Meeting each of James Cacioppo, Benjamin Cross, Stephen Monroe, Marina Hahn and Billy Wafford, each to serve as a director of the Company until the next Meeting at which the election of directors is considered, or until his/her successor is duly elected or appointed, unless he/she resigns, is removed or becomes disqualified in accordance with the Articles or the BCBCA. The persons named in the accompanying Proxy Instrument intend to vote for the election of such persons at the Meeting, unless otherwise directed. The Board does not contemplate that any of the nominees will be unable to serve as a director of the Company. However, if anyone nominated by the Board is unable to accept election, the proxies will be voted for the election of such other person or persons as the Board may recommend.

The following table and the notes thereto set out the name and age of each director nominee (as of April 23, 2024), their respective existing positions and, if applicable, the period during which he/she has been a director of the Company.

| | | | | | | | | | | | | | |

Directors Name | Age | Position(s) | Location of Residence | Director Since |

James Cacioppo (1)(2) | 61 | Chairman | Florida, US | 2018 |

Benjamin Cross (1)(2)(3) | 69 | Director | Connecticut, US | 2019 |

Stephen Monroe (1)(2)(3)(4) | 64 | Director | New York, US | 2019 |

Marina Hahn | 66 | Director | New York, US | 2021 |

Billy Wafford (3) | 52 | Director | California, US | 2022 |

(1)Nominating and Corporate Governance Committee member

(2)Compensation Committee member

(3)Audit Committee member

(4)Lead Independent Director

Biographical Information

The biographies of the proposed nominees for the Board are set out below.

James Cacioppo, brings managerial, start-up, financial and investing experience to his role as Founder, Chief Executive Officer (“CEO”) and Chairman of the Company. Prior to founding the Company, Mr. Cacioppo spent over two decades managing the business and allocating capital in senior management positions at several large hedge funds; two of which were early-stage success stories. Mr. Cacioppo is Co-Founder and Managing Partner of One East Partners (US$2.3 billion (peak AUM)). Previously, Mr. Cacioppo served as President and Co-Portfolio Manager of Sandell Asset Management (US$5.0 billion (peak AUM)) and Head of Distressed Debt for Halcyon Management, a global investment firm with over US$9 billion in assets. Mr. Cacioppo earned his BA from Colgate University and his MBA from Harvard University.

Benjamin Cross, brings extensive financial markets experience and commodities knowledge to his role as Director at Jushi. Mr. Cross spent 20 years at Morgan Stanley in both their London and New York offices in the Commodities division until his retirement in 2015 as a Managing Director at the firm. Prior to joining Morgan Stanley, Mr. Cross worked at Merrill Lynch and the commodities exchange. Mr. Cross earned his BS from Cornell University. Presently, Mr. Cross is a Board Advisor to Ursa Space, a geospatial intelligence firm with an emphasis in measuring global oil inventories.

Stephen Monroe, brings vast experience in financial markets and risk management to his role as Director at Jushi. Mr. Monroe is President and Managing Partner of Liquid Capital Alternative Funding (LCAF), an asset-based lender. Prior to joining LCAF, Mr. Monroe served as National Sales Manager for Short Duration Products at JP Morgan and was previously employed in a variety of

senior management positions covering cash and short duration products at Barclays and the Royal Bank of Scotland. Mr. Monroe earned his BA from Williams College.

Marina Hahn, brings extensive board and consumer brand experience to her role as Director at Jushi. Ms. Hahn co-founded HOUSEOFLOVE, a ready to drink retail beverage line and currently serves as General Manager. Prior to co-founding HOUSEOFLOVE, Ms. Hahn served as a consultant at Rotkaeppchen-Mumm, a German market leader in sparkling wines and spirits. Prior to serving as a consultant at Rotkaeppchen-Mumm, Ms. Hahn co-founded ZX Ventures, a growth arm of Anheuser-Busch. Prior to ZX Ventures, Ms. Hahn served as President of the Consumer Division at Flex Pharma, an innovative biotech formed as a result of a scientific breakthrough for athletes who suffer from muscle cramps. Ms. Hahn was a founder of SVEDKA Vodka (acquired by Constellation Brands, Inc.), an irreverent lifestyle brand where she originated the iconic spokesbot, SVEDKA_grl. Ms. Hahn is a graduate of Wellesley College.

Billy Wafford, has over 25 years of finance and management consulting experience that he brings to his role as Director at Jushi. Mr. Wafford currently serves as Chief Financial Officer of Qurate Retail Group (part of Qurate Retail, Inc., a Fortune 500 company) a video commerce focused retailer that includes brands such as QVC®, HSN®, Zulily®, Ballard Designs®, Frontgate®, Garnet Hill® and Grandin Road®. Prior to Qurate Retail Group, he served as Chief Financial Officer of Everlane, a digitally native apparel, footwear and accessories brand, JCPenney, one of the largest retail department chains in the U.S., The Vitamin Shoppe, a specialty retailer of nutritional products, and Thrasio, a global consumer goods company. Mr. Wafford also previously served as Partner of the advisory practice group at KPMG, after holding various executive finance roles with Walgreens Boots Alliance, Target, Archstone Consulting, and Bank of America. Mr. Wafford earned his MBA from Indiana University.

The persons named in the accompanying Proxy Instrument (if named and absent contrary directions) intend to vote the shares represented thereby “FOR” the election of each of the aforementioned named nominees unless otherwise instructed on a properly executed and validly deposited proxy.

Corporate Cease Trade Orders, Bankruptcies, Penalties or Sanctions

On April 21, 2021, the Company announced it had applied to the Ontario Securities Commission (the “OSC”), as principal regulator of the Company, for the imposition of a management cease trade order (the “MCTO”) under National Policy 12-203 – Management Cease Trade Orders because, due to the Company’s auditor not being able to complete its annual audit procedures in a timely manner, the Company would not be able to file its audited annual financial statements for the year ended December 31, 2020, the related management’s discussion and analysis, related Chief Executive Officer and Chief Financial Officer certificates and annual information form for the year ended December 31, 2020 (the “Required Filings”) before the required deadline of April 30, 2021. On May 3, 2021, the OSC issued the MCTO. The MCTO restricted the trading of securities of the Corporation by the Chief Executive Officer and Chief Financial Officer of the Corporation until the Required Filings were made. The Required Filings were made on June 9, 2021, and the MCTO was automatically revoked. All of the Company’s current directors and named executive officers, except Michelle Mosier, Marina Hahn and Billy Wafford, were in place on the date when the MCTO was issued on May 3, 2021.

Except for the MCTO, to the Company's knowledge, no proposed director is or, within the ten (10) years prior to the date of this Proxy Statement, has been, a director, Chief Executive Officer or Chief Financial Officer of any company (including the Company) that: (i) while that person was acting in that capacity was the subject of a cease trade order or similar order, or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than thirty (30) consecutive days (an “order”); or (ii) after that person ceased acting in that capacity, was subject to an order, which resulted from an event that occurred while that person was acting in the capacity of director, Chief Executive Officer or Chief Financial Officer.

On February 22, 2022, Jushi Europe SA (“Jushi Europe”), an entity owned 51% by the Company, filed a notice of over-indebtedness with the Swiss courts. The Swiss court declared Jushi Europe’s bankruptcy on May 19, 2022 (the “Jushi Europe Bankruptcy”). Jim Cacioppo is a director of Jushi Europe.

On May 15, 2020, J.C. Penney Company, Inc. (“J.C. Penney”) and certain other debtors filed voluntary petitions for relief under chapter 11 of title 11 of the United States Code (the “J.C. Penney Bankruptcy”). Billy Wafford was the Executive Vice President and Chief Financial Officer of J.C. Penney at the time of the J.C. Penney Bankruptcy filing.

Except with respect to Jushi Europe Bankruptcy and the J.C. Penney Bankruptcy, to the Company's knowledge, no proposed director is or, within the ten (10) years prior to the date hereof, has been, a director or executive officer of any company (including the Company) that while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

To the Company's knowledge, no proposed director has, during the ten (10) years prior to the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or became subject to or instituted any proceedings,

arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold assets of the proposed director.

Certain Relationships and Related Party Transactions

The following is a summary of transactions since January 1, 2023 to which we have been a participant in which the amount involved exceeded or will exceed $120,000, and in which any of our then directors, executive officers or holders of more than 5% of any class of our capital stock at the time of such transaction, or any members of their immediate family, had or will have a direct or indirect material interest.

Other than as described below under this section titled “Certain Relationships and Related Party Transactions,” since January 1, 2023, we have not entered into any transactions, nor are there any currently proposed transactions, between the Company and a related party where the amount involved exceeds, or would exceed, $120,000, and in which any related person had or will have a direct or indirect material interest.

Extension of Stock Option Post-Termination Exercise Period

On April 12, 2023, our Board approved an extension of the post-termination exercise period (the “PTEP Amendment”) for stock options previously granted to Jon Barack (President), Michelle Mosier (Chief Financial Officer), Tobi Lebowitz (Chief Legal Officer and Corporate Secretary), Benjamin Cross (Independent Director), Stephen Monroe (Independent Director), Marina Hahn (Independent Director) and Billy Wafford (Independent Director) under our 2019 Equity Incentive Plan, as amended (the “2019 Equity Incentive Plan”). Pursuant to the PTEP Amendment, the post-termination exercise period upon a termination of employment for any reason other than for (i) “cause” (as defined in the applicable option award agreement) or (ii) voluntary resignation occurring prior to a “change in control” (as defined in the 2019 Equity Incentive Plan) for the outstanding stock options to purchase 3,369,923 subordinate voting shares held by Mr. Barack was amended to 18 months, and the post-termination exercise period for any reason other than for cause occurring after a change in control for the outstanding stock options to purchase 3,369,923 subordinate voting shares held by Mr. Barack was amended to 3 years. Pursuant to the PTEP Amendment, the post-termination exercise period upon a termination of employment for any reason other than for (i) cause (as defined in the applicable option award agreement) or (ii) voluntary resignation occurring prior to a change in control (as defined in the 2019 Equity Incentive Plan) for the outstanding stock options to purchase an aggregate of 2,089,758 subordinate voting shares held by Ms. Mosier, Ms. Lebowitz, Mr. Cross, Mr. Monroe, Ms. Hahn and Mr. Wafford was amended to 1 year, and the post-termination exercise period for any reason other than for cause occurring after a change in control for the outstanding stock options to purchase an aggregate of 2,089,758 subordinate voting shares held by Ms. Mosier, Ms. Lebowitz, Mr. Cross, Mr. Monroe, Ms. Hahn and Mr. Wafford was amended to 2 years.

Indenture and Warrant Amendments

On June 27, 2023, we and Odyssey Trust Company, as trustee, entered into an amendment to our existing Trust Indenture dated December 7, 2022, pursuant to which the Company issued 12% Second Lien Notes (the “Notes”) in December 2022. Additionally, on June 27, 2023, we and Acquiom Agency Services, LLC, as collateral agent, entered into an amendment to the detached warrants issued to the holders of the Notes (the “Warrants”). The amendment to the Indenture removed the covenant, upon a change of control, giving the right to holders of Notes to require the Company to repurchase the Notes for 105% of the then outstanding principal and accrued and unpaid interest, and provided that previous leverage limits on the Company with respect to the Manassas, VA facility do not apply in certain circumstances. The amendment to the Warrants reduced the exercise price for each subordinate voting share from US$2.086 to US$1.00 and provided that future adjustments to the Warrants, if any, will be determined using a pricing model in accordance with generally accepted accounting principles in the United States. James Cacioppo, our CEO and the Chairman of the Board, and Denis Arsenault, a holder of more than 5% of any class of our capital stock at the time of this transaction, both hold Notes and Warrants.

Option Repricing

On November 15, 2023, the disinterested directors on our Board approved a stock option cancellation and regrant program, pursuant to which certain members of our senior management team, including Mr. Barack and Ms. Lebowitz, and independent directors Mr. Cross, Mr. Monroe and Ms. Hahn, were permitted to elect to cancel each option held by the eligible participant with an exercise price per subordinate voting share greater than or equal to $3.91, and to be granted a replacement option to purchase an identical number of subordinate voting shares on the first date such grant was eligible to be made after the expiration of a 30-day period measured from the cancellation date and otherwise in compliance with US and Canadian law and applicable stock exchange rules, at an exercise price per subordinate voting share equal to the fair market value of a subordinate voting share on the grant date subject to certain limitations set forth in the Company’s 2019 Equity Incentive Plan. Mr. Barack and Ms. Lebowitz elected to participate in such program. Consequently, on December 17, 2023, Mr. Barack had 1,000,000 options repriced from $3.91 per subordinate voting share to $0.55 per subordinate voting share and Ms. Lebowitz had 465,000 options repriced from $3.91 per subordinate voting share to $0.55 per subordinate voting share. The vesting schedule for Mr. Barack’s replacement options restarted on the replacement option grant date, and vests in three equal annual installments measured from the replacement option

grant date. The vesting schedule with respect to 165,000 of Ms. Lebowitz replacement options restarted on the replacement option grant date, and vests in three equal annual installments measured from the replacement option grant date. The vesting schedule with respect to 165,000 of Ms. Lebowitz replacement options did not change. Mr. Cross, Mr. Monroe and Ms. Hahn elected to participate in such program. Consequently, on December 17, 2023, the directors had 140,000 options repriced from $3.91 per subordinate voting share to $0.55 per subordinate voting share. The vesting schedule for the directors’ replacement options restarted on the replacement option grant date, and vests on year from the replacement option grant date.

Warrant Cancellation and Re-Issuance

On November 15, 2023, we informed Michelle Mosier, our Chief Financial Officer, that a warrant issued to her on December 9, 2022, permitting her to purchase up to 200,000 subordinate voting shares at an exercise price per subordinate voting share of $1.75 inadvertently contained a technical defect and was not in compliance with the policies of the Canadian Securities Exchange. As a result, the defective warrant was cancelled. In order to compensate Ms. Mosier for the cancellation of the defective warrant, the Board approved for Ms. Mosier to be issued a replacement warrant to purchase an identical number of subordinate voting shares on the first date such issuance was eligible to be made, after the expiration of a 30-day period measured from the cancellation date and otherwise in compliance with US and Canadian law and applicable stock exchange rules, at an exercise price per subordinate voting share equal to the fair market value of a subordinate voting share on the issuance date. Consequently, on December 17, 2023, Ms. Mosier was issued a warrant to purchase 200,000 subordinate voting shares at an exercise price per subordinate voting share of $0.55.

Policy Regarding Related Party Transactions

We do not have any formal written policies and procedures for the review, approval, or ratification of transactions with related persons or conflicted transactions. However, in practice, when such transactions arise, they are referred to the Board for consideration and approval, and we rely on the Board to review related party transactions on an ongoing basis to prevent conflicts of interest. We intend to adopt a related party transaction policy in the future. In addition, as we are listed on the Canadian Securities Exchange and are a reporting issuer under Canadian securities laws, we are subject to Multilateral Instrument 61-101 – Protection of Minority Securityholders in Special Transactions (“MI 61-101”) which includes requirements in connection with, among other things, “related party transactions” being transactions by which an issuer directly or indirectly engages in the following with a related party: acquires, sells, leases or transfers an asset, acquires the related party, acquires or issues treasury securities, amends the terms of a security if the security is owned by the related party or assumes or becomes subject to a liability or takes certain other actions with respect to debt. For the purposes of MI 61-101, the term “related party” includes directors, senior officers and holders of more than 10% of the voting rights attached to all outstanding voting securities of the issuer or holders of a sufficient number of any securities of the issuer to materially affect control of the issuer. MI 61-101 requires, subject to certain exceptions, the preparation of a formal valuation relating to certain aspects of the transaction and more detailed disclosure in the proxy material sent to security holders in connection with a related party transaction including related to the valuation. MI 61-101 also requires, subject to certain exceptions, that an issuer not engage in a related party transaction unless the shareholders of the issuer, other than the related parties, approve the transaction by a simple majority of the votes cast.

Indebtedness of Directors, Executive Officers and Employees

No individual who is, or at any time during the most recently completed fiscal year of the Company was, a director or executive officer of the Company, and no proposed nominee for election as a director of the Company, or any associate of any such director, executive officer or proposed nominee: (i) is or at any time since the beginning of the Company’s most recently completed fiscal year has been, indebted to the Company or any of its subsidiaries; or (ii) whose indebtedness to another entity is, or at any time since the beginning of the Company’s most recently completed fiscal year has been, the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company or any of its subsidiaries

Requirements under the Business Corporations Act (British Columbia)

Pursuant to the BCBCA, directors and officers are required to act honestly and in good faith with a view to the best interests of the Company. Under the BCBCA, subject to certain limited exceptions, a director who holds a disclosable interest in a material contract or transaction into which we have entered or propose to enter shall not vote on any directors' resolution to approve the contract or transaction. A director or officer has a disclosable interest in a material contract or transaction if the director or officer:

•is a party to the contract or transaction;

•is a director or officer, or an individual acting in a similar capacity, of a party to the contract or transaction; or

•has a material interest in a party to the contract or transaction.

Generally, as a matter of practice, directors or officers who have disclosed a material interest in any contract or transaction that the Board is considering will not take part in any Board discussion respecting that contract or transaction. If such directors were to participate in the discussions, they would abstain from voting on any matters relating to matters in which they have disclosed a disclosable interest.

Interests of Management of the Company and Others in Material Transactions

Other than as described elsewhere in this Proxy Statement, there are no material interests, direct or indirect, of any of our directors or executive officers, any shareholder that beneficially owns, or controls or directs (directly or indirectly), more than 10% of any class or series of our outstanding voting securities, or any associate or affiliate of any of the foregoing persons, in any transaction since the beginning of the year ended December 31, 2023 that has materially affected or is reasonably expected to materially affect the Company or its subsidiaries.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” SETTING THE NUMBER OF DIRECTORS AT FIVE (5) IN PROPOSAL 1 AND “FOR” THE ELECTION OF THE NOMINEES IN PROPOSAL 2.

PROPOSAL 3: APPOINTMENT AND REMUNERATION OF AUDITORS

The audit committee of our Board (the “Audit Committee”) has appointed Macias Gini & O'Connell LLP (“MGO”) as our independent registered accounting firm for the fiscal year ending December 31, 2024. Although ratification of the appointment of MGO by our stockholders is not required, the Board is submitting the selection of MGO to our stockholders for ratification as a matter of good corporate governance. If the selection is not ratified, the Audit Committee will but is not obligated to consider whether it is appropriate to select another independent registered public accounting firm. Ratification requires the receipt of “FOR” votes constituting a majority of the shares cast by the shareholders who vote in respect of this proposal. Representatives of MGO are expected to attend the Meeting, with the opportunity to make a statement if they so desire and, if a representative is in attendance, the representative will be available to answer appropriate questions.

Changes in Certifying Accountant

On April 19, 2023, our Audit Committee dismissed Marcum LLP (“Marcum”) as the Company’s independent registered public accounting firm. The reports of Marcum on the consolidated financial statements of the Company and its subsidiaries as of and for the fiscal years ended December 31, 2022 and 2021 did not contain an adverse opinion or a disclaimer of opinion, and it was not qualified or modified as to uncertainty, audit scope or accounting principles, except that the audit report on the financial statements of the Company for the fiscal year ended December 31, 2022 included an explanatory paragraph that raised substantial doubt about the Company's ability to continue as a going concern as a result of recurring losses from operations, negative cash flows from operations, non-compliance with certain debt covenants and a working capital deficit.

Marcum was engaged by the Company from June 2, 2021 through April 19, 2023, to conduct audits of the Company’s financial statements for fiscal years ended December 31, 2022, 2021 and 2020 and reviews of the Company’s financial statements for each fiscal quarter of 2022 and 2021. During the two most recent fiscal years and the subsequent interim period through the date of Marcum’s dismissal, there were (a) no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between the Company and Marcum on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreement(s), if not resolved to the satisfaction of Marcum, would have caused Marcum to make reference to the subject matter of such disagreement(s) in connection with its audit reports, and (b) no reportable events (as described in Item 304(a)(1)(v) of Regulation S-K), except: the identification of deficiencies that constitute material weaknesses in internal control over financial reporting as detailed in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on April 18, 2023. The material weaknesses were discussed with the Audit Committee of the Company, and the Company has authorized Marcum to respond fully to inquiries of the successor independent registered public accounting firm.

We previously provided Marcum with a copy of the above disclosures as included in our Form 8-K filed with the SEC on April 25, 2023, and requested Marcum to furnish us with a letter addressed to the SEC stating whether Marcum agreed with the statements made by us in response to Item 304(a) of Regulation S-K and, if not, stating the respects in which it does not agree. A copy of Marcum’s letter, dated April 24, 2023, is attached as Exhibit 16.1 to that Form 8-K, and is incorporated herein by reference.

On April 20, 2023, the Audit Committee approved the engagement of MGO as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023, effective immediately. During the Company’s fiscal years ended December 31, 2022 and 2021, and the subsequent interim period through April 19, 2023, neither the Company nor anyone acting on its behalf consulted with MGO regarding: (i) the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report nor oral advice was provided to the Company that MGO concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue, (ii) any matter that was the subject of a disagreement within the meaning of Item 304(a)(1)(iv) of Regulation S-K, or (iii) any “reportable event” within the meaning of Item 304(a)(1)(v) of Regulation S-K.

Principal Independent Accountant Fees and Services

Aggregate fees billed by our principal independent auditor, MGO, and our former principal independent auditor, Marcum, for the years ended December 31, 2023 and 2022 are detailed in the table below.

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2023 | | 2022 |

Audit Fees (1) | | $ | 1,615,000 | |

| $ | 1,838,000 | |

Audit Related Fees (2) | | 318,000 | | | 525,000 | |

Tax Fees (3) | | — | | | — | |

All Other Fees (4) | | — | | | 1,009,000 | |

| Total Fees Paid | | $ | 1,933,000 | | | $ | 3,372,000 | |

| | |

(1) “Audit Fees” includes the aggregate fees billed for the audit of the annual consolidated US GAAP financial statements. |

(2) “Audit Related Fees” includes the aggregate fees billed for the review of interim unaudited consolidated US GAAP financial statements, comfort letters, consents, and reviews of securities filings. |

(3) “Tax fees” includes the aggregate fees billed for professional services rendered for tax compliance, tax advice and tax planning. |

(4) “All other fees” includes fees related to the audit of the 2021 and 2020 US GAAP financial statements in preparation for the Corporation's expected registration with the Securities and Exchange Commission. |

Pre-approval Policies and Procedures

Our Audit Committee has established a policy of reviewing, in advance, and either approving or not approving, all audit, audit-related, tax and other non-audit services that our independent registered public accounting firm provides to us. This policy requires that all services received from independent registered public accounting firms be approved in advance by the Audit Committee. The Audit Committee has delegated pre-approval responsibility to the Chair of the Audit Committee with respect to non-audit related fees and services.

Our Audit Committee has determined that the provision of the services as set out above is compatible with the maintaining of MGO's independence in the conduct of their auditing functions.

Audit Committee Report

The primary purpose of the Audit Committee is to assist the Company's Board in fulfilling its responsibilities for oversight of financial, audit and accounting matters. The Audit Committee reviews the financial reports and other financial information provided by the Company to regulatory authorities and its shareholders, as well as reviews the Company's system of internal controls regarding finance and accounting, including auditing, accounting and financial reporting processes.

The Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 2023 with management. The Audit Committee has also discussed with Marcum, the Company's prior independent registered public accounting firm, the matters required to be discussed under applicable auditing standards, including Auditing Standard No. 1301. In addition, the Audit Committee discussed with Marcum its independence, and received from Marcum the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board. Finally, the Audit Committee discussed Marcum, with and without management present, the scope and results of Marcum's audit of such financial statements.

Based on these reviews and discussions, the Audit Committee recommended to the Board that such audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2023.

Audit Committee of the Board

The Audit Committee of the Board currently consists of Billy Wafford (Chair), Stephen Monroe and Benjamin Cross. Each of the members of the Audit Committee meets the independence requirements pursuant to NI 52-110 and each is financially literate within the meaning of NI 52-110.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPOINTMENT AND TO FIX THE REMUNERATION AND TERMS OF ENGAGEMENT OF OUR AUDITORS IN PROPOSAL 3.

PROPOSAL 4: APPROVAL AND RENEWAL OF THE EQUITY INCENTIVE PLAN

The Canadian Securities Exchange (“CSE”) amended its listing requirements to require that every three years after an issuer’s adoption of a security-based compensation arrangement that does not have a fixed maximum number of securities issuable, such as the Company’s 2019 Equity Incentive Plan, all unallocated rights, options or other entitlements under such arrangement must be approved by the issuer’s shareholders. The 2019 Equity Incentive Plan was most recently approved by the shareholders on June 30, 2021. On April 25, 2024 the Board unanimously determined that the adoption and renewal of the 2019 Equity Incentive Plan is in the best interests of the Company and unanimously approved the adoption and renewal of the 2019 Equity Incentive Plan. Accordingly, in accordance with this new requirement of the CSE, our shareholders are being asked at the Meeting to consider and, if thought appropriate, to pass an ordinary resolution to approve the 2019 Equity Incentive Plan and the unallocated Awards (as defined below) that may be granted under the 2019 Equity Incentive Plan.

Pursuant to the ordinary resolution, the full text of which is reproduced as Appendix “A”, and in accordance with the policies of the CSE, the Company proposes to approve and renew the 2019 Equity Incentive Plan, the full text of which is set forth in Appendix “B” to this Proxy Statement, and all Awards issuable thereunder.

If the resolution is not passed, no further Awards will be granted under the 2019 Equity Incentive Plan after the date of the Meeting unless and until we subsequently obtain shareholder approval of the adoption and renewal of the plan. Outstanding Awards as of the date of the Meeting will not be affected by this Proposal 4.