Exhibit 99.1

The Next Generation Cannabis Platform

Cautionary Statement Regarding Forward - Looking Statements This presentation contains certain "forward - looking information" within the meaning of applicable Canadian securities legislation as well as statements that may constitute "forward - looking statements“ within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements, other than statements of historical facts, contained in this presentation, including statements regarding our strategy, future operations, intended expansion of our retail operations and production capacity, intended expansion of our cultivation facilities, future financial position, projected costs, prospects, plans and objectives of management, are forward - looking statements . These forward - looking statements are based on Jushi’s current expectations and beliefs concerning future developments and their potential effects . As a result, actual results could differ materially from those expressed by such forward - looking statements and such statements should not be relied upon . Generally, such forward - looking information or forward - looking statements can be identified by the use of forward - looking terminology such as “plans,” “expects” or “does not expect,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates” or “does not anticipate,” or “believes,” or variations of such words and phrases or may contain statements that certain actions, events or results “may,” “could,” “would,” “might” or “will be taken,” “will continue,” “will occur” or “will be achieved” . The forward - looking information and forward - looking statements contained herein may include but are not limited to, information concerning the expectations regarding Jushi, or the ability of Jushi to successfully achieve business objectives, and expectations for other economic, business, and/or competitive factors . Many factors could cause actual future events to differ materially from the forward - looking statements in this presentation, including risks related to the ability of Jushi to successfully and/or timely achieve business objectives, including with regulatory bodies, employees, suppliers, customers and competitors ; changes in general economic, business and political conditions, including changes in the financial markets ; changes in applicable laws ; and compliance with extensive government regulation, as well as other risks, uncertainties and other cautionary statements in the Company’s public filings with the applicable securities regulatory authorities on the SEC’s website at www . sec . gov and on SEDAR at www . sedar . com . Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward - looking information or statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated, or expected . Although the Company believes that the assumptions and factors used in preparing, and the expectations contained in, the forward - looking information and statements are reasonable, undue reliance should not be placed on such information and statements, and no assurance or guarantee can be given that such forward - looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information and statements . The forward - looking information and forward - looking statements contained in this presentation are made as of the date of this presentation, and the Company does not undertake to update any forward - looking information and/or forward - looking statements that are contained or referenced herein, except in accordance with applicable securities laws . All subsequent written and oral forward - looking information and statements attributable to the Company or persons acting on its behalf is expressly qualified in its entirety by this notice . Operational Results Advisory Any statements regarding the Company's estimated operations following Q 4 and year ended December 31 , 2023 , do not present all information necessary for an understanding of the Company's current or future results of operations and undue reliance should not be placed on such estimates, all of which are "forward - looking information" and "forward - looking statements" subject to the risks and uncertainties described above . 2

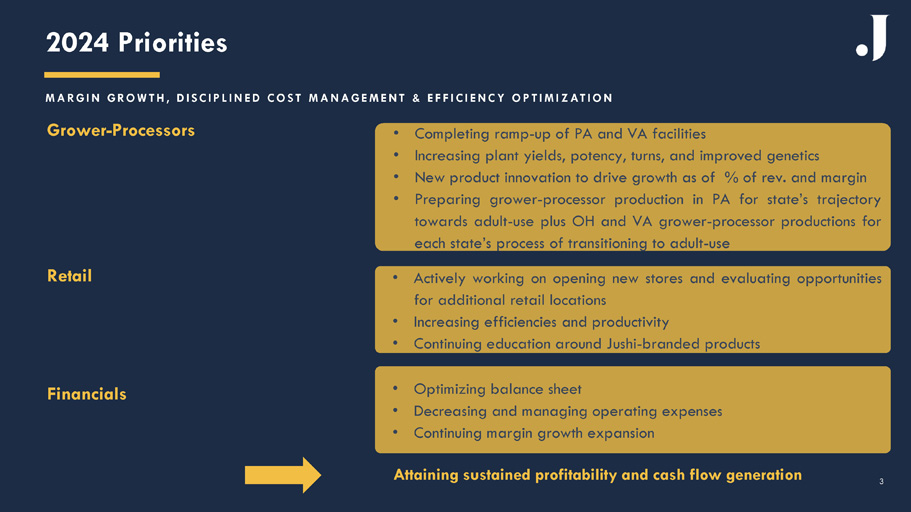

2024 Priorities Grower - Processors Retail Financials M A R G I N G RO W T H , D I S C I P L I N E D C O S T M A N A G E M E N T & E F F I C I E N C Y OP T I M I Z AT I O N • Completing ramp - up of PA and VA facilities • Increasing plant yields, potency, turns, and improved genetics • New product innovation to drive growth as of % of rev. and margin • Preparing grower - processor production in PA for state’s trajectory towards adult - use plus OH and VA grower - processor productions for each state’s process of transitioning to adult - use • Actively working on opening new stores and evaluating opportunities for additional retail locations • Increasing efficiencies and productivity • Continuing education around Jushi - branded products • Optimizing balance sheet • Decreasing and managing operating expenses • Continuing margin growth expansion Attaining sustained profitability and cash flow generation 3

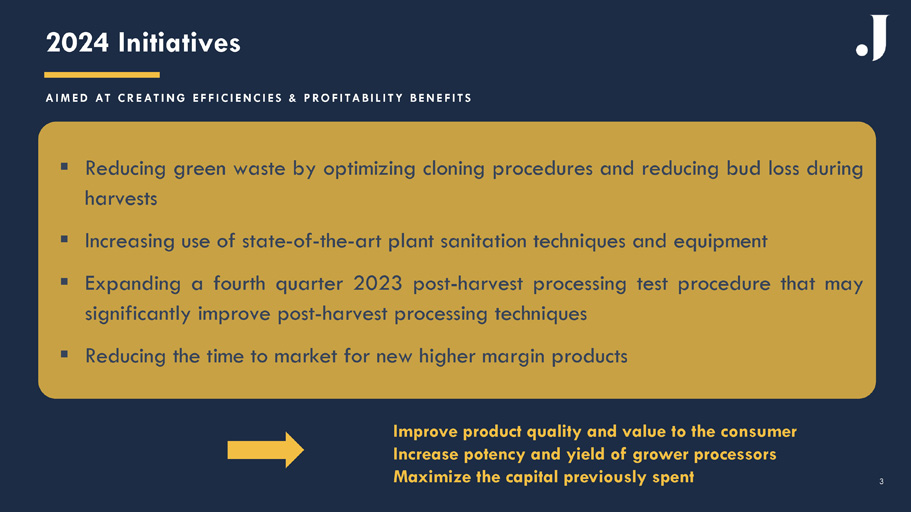

2024 Initiatives A I M E D AT C R E AT I N G E F F I C I E N C I E S & P RO F I TA B I L I T Y B E N E F I T S ▪ Reducing green waste by optimizing cloning procedures and reducing bud loss during harvests ▪ Increasing use of state - of - the - art plant sanitation techniques and equipment ▪ Expanding a fourth quarter 2023 post - harvest processing test procedure that may significantly improve post - harvest processing techniques ▪ Reducing the time to market for new higher margin products Improve product quality and value to the consumer Increase potency and yield of grower processors Maximize the capital previously spent 3

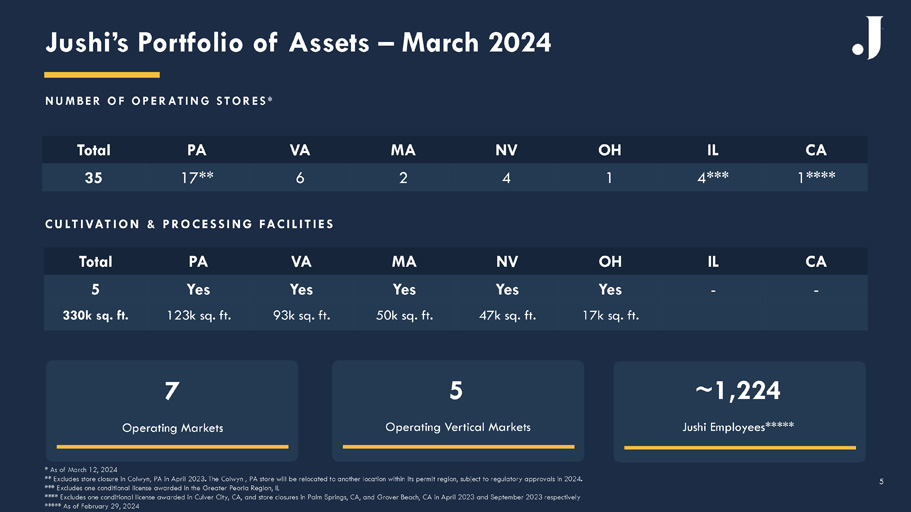

7 Operating Markets 5 Operating Vertical Markets ~1,224 Jushi Employees***** CA IL OH NV MA VA PA Total 1**** 4*** 1 4 2 6 17** 35 C U LT I VAT I O N & P RO C E S S I N G FAC I L I T I E S CA IL OH NV MA VA PA Total - - Yes Yes Yes Yes Yes 5 17k sq. ft. 47k sq. ft. 50k sq. ft. 93k sq. ft. 123k sq. ft. 330k sq. ft. Jushi’s Portfolio of Assets – March 2024 N U M B E R O F O P E R AT I N G S T O R E S * 5 * As of March 12, 2024 ** Excludes store closure in Colwyn, PA in April 2023. The Colwyn , PA store will be relocated to another location within its permit region, subject to regulatory approvals in 2024. *** Excludes one conditional license awarded in the Greater Peoria Region, IL **** Excludes one conditional license awarded in Culver City, CA, and store closures in Palm Springs, CA, and Grover Beach, CA in April 2023 and September 2023 respectively ***** As of February 29, 2024

~123k Sq. Ft. Facility Vertically Integrated with 17* Medical Dispensaries (out of ~177 (1) ; ~10% of market) 17* Dispensaries ~13M PA Population (2) ~942k** Market Patients & Caregivers (3) (7.3% of Pop) ~436k Market Active Patients (4) (3.4% of Pop) Pennsylvania Highlights P R I M A RY M A R K E T D R I V E R S Scan to see more about Pennsylvania on your phone. https://jushico.com/pa - highlights * Colwyn store closed in April 2023 and will be relocated to another location within its permit region, subject to regulatory approvals in 2024. ** Through July 2023, the last publicly available published date of information 6

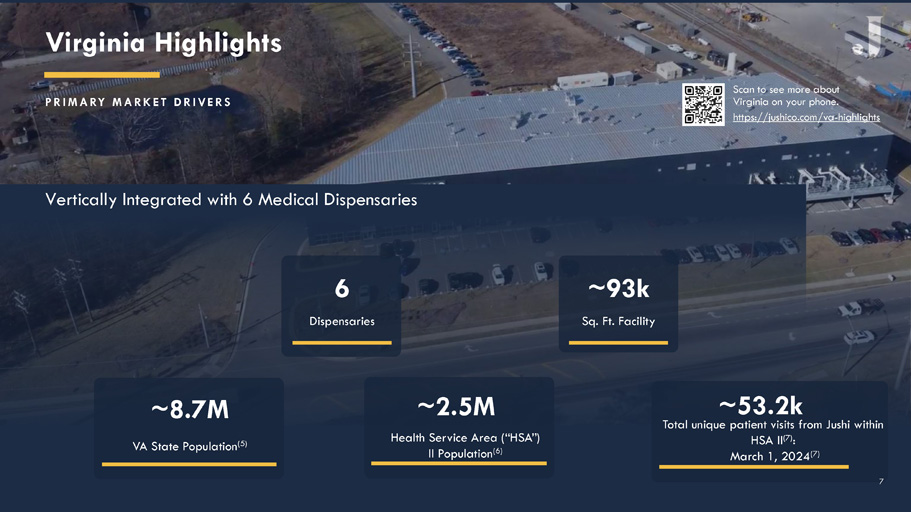

~93k Sq. Ft. Facility 6 Dispensaries ~8.7M VA State Population (5) ~2.5M Health Service Area (“HSA”) II Population (6) Virginia Highlights P R I M A RY M A R K E T D R I V E R S ~53.2k Total unique patient visits from Jushi within HSA II (7) : March 1, 2024 (7) Scan to see more about Virginia on your phone. https://jushico.com/va - highlights Vertically Integrated with 6 Medical Dispensaries 7

2 Dispensaries MA & NV Highlights S E C O N DA RY M A R K E T D R I V E R S ~50k Sq. Ft. Facility N E VA DA M A S S AC H U S E T T S Vertically Integrated with 2 Dispensaries Vertically Integrated with 4 Dispensaries 4 Dispensaries ~47k Sq. Ft. Facility Grower - processor production meeting current product demand with flexibility to expand current scale as needed Grower - processor production focusing on launching several of our Jushi - branded products to achieve optimal production and high efficiency levels 8

OH, IL & CA Highlights I L L I N O I S 4 Dispensaries Plus, conditional license awarded in the Greater Peoria Region, IL to Jushi’s partner Northern Cardinal Ventures, LLC subject to regulatory approvals C A L I F O R N I A 1 Dispensary ~17k Sq. Ft. Facility 1 Flower Room 1* Dispensaries * Palm Springs store closed in April 2023 and Grover Beach store closed in September 2023 D E V E L O P I N G M A R K E T D R I V E R S O H I O Vertically Integrated with 1 Dispensary 9 Plus, conditional license awarded in Culver City, CA subject to regulatory approvals

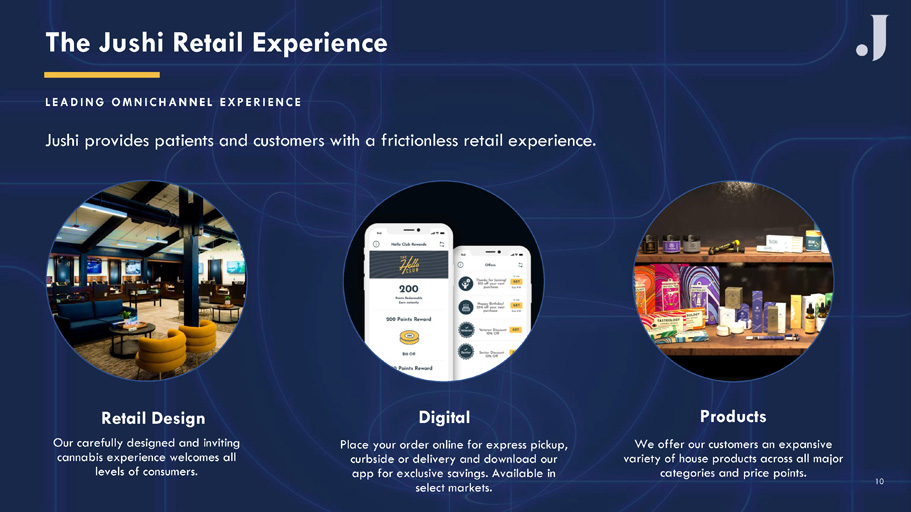

Jushi provides patients and customers with a frictionless retail experience. Digital Place your order online for express pickup, curbside or delivery and download our app for exclusive savings. Available in select markets. Retail Design Our carefully designed and inviting cannabis experience welcomes all levels of consumers. Products We offer our customers an expansive variety of house products across all major categories and price points. The Jushi Retail Experience L E A D I N G O M N I C H A N N E L E X P E R I E N C E 10

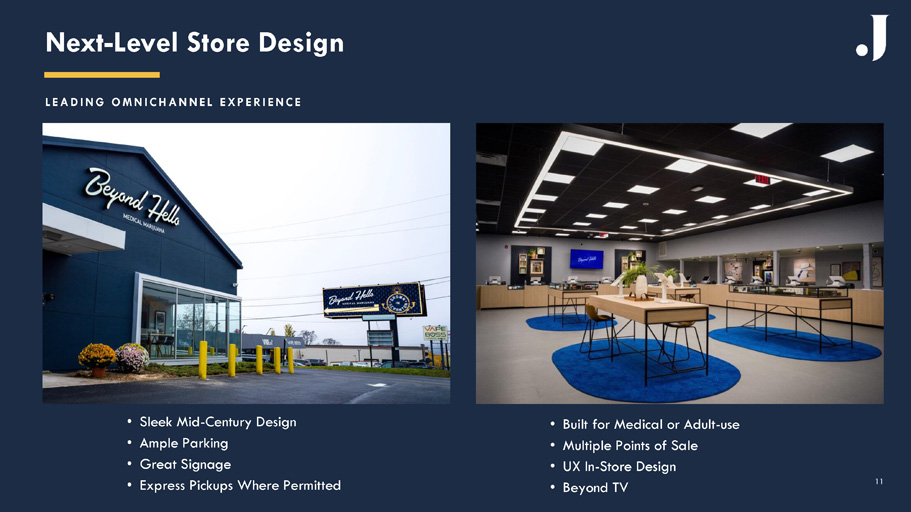

Next - Level Store Design L E A D I N G O M N I C H A N N E L E X P E R I E N C E 11 • Sleek Mid - Century Design • Ample Parking • Great Signage • Express Pickups Where Permitted • Built for Medical or Adult - use • Multiple Points of Sale • UX In - Store Design • Beyond TV

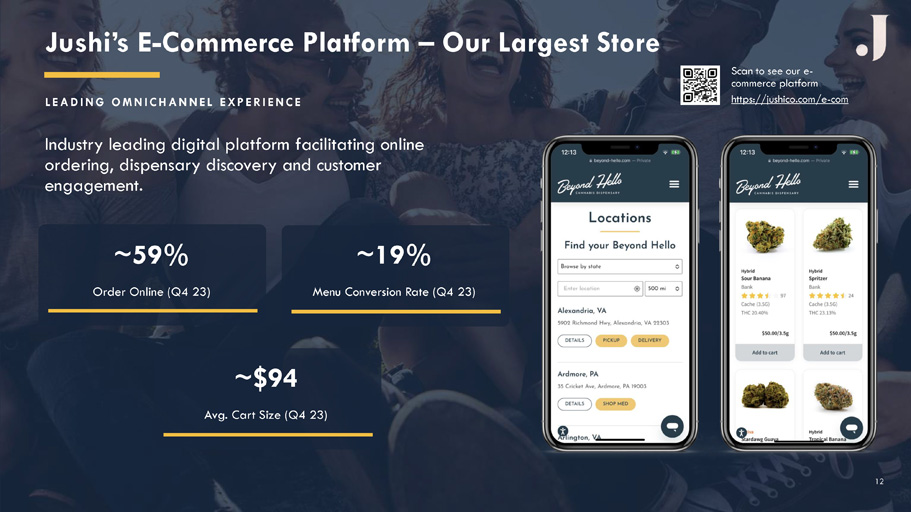

Industry leading digital platform facilitating online ordering, dispensary discovery and customer engagement. ~59% Order Online (Q4 23) ~19% Menu Conversion Rate (Q4 23) ~$94 Avg. Cart Size (Q4 23) Jushi’s E - Commerce Platform – Our Largest Store L E A D I N G O M N I C H A N N E L E X P E R I E N C E Scan to see our e - commerce platform https://jushico.com/e - com 12

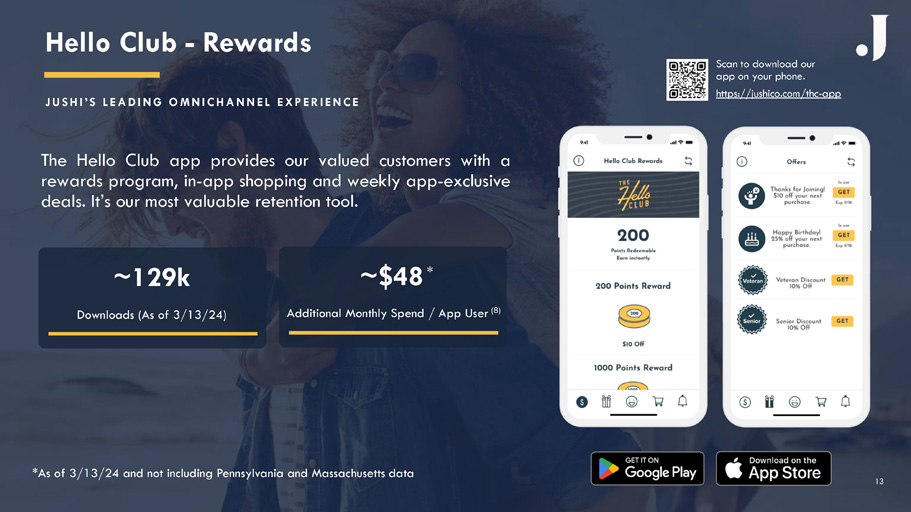

The Hello Club app provides our valued customers with a rewards program, in - app shopping and weekly app - exclusive deals . It’s our most valuable retention tool . ~129k Downloads (As of 3/13/24) Hello Club - Rewards J U S H I ’ S L E A D I N G O M N I C H A N N E L E X P E R I E N C E Scan to download our app on your phone. https://jushico.com/thc - app ~$48 * Additional Monthly Spend / App User (8) *As of 3/13/24 and not including Pennsylvania and Massachusetts data 13

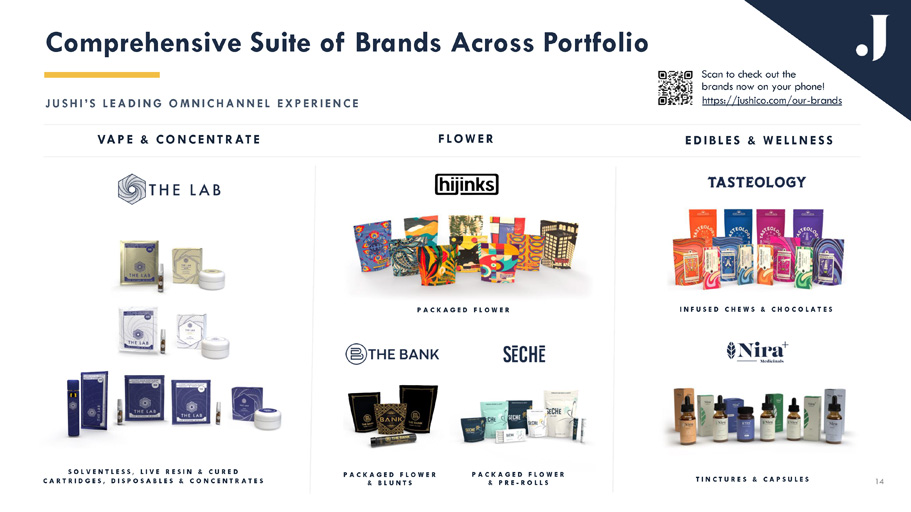

VA P E & C O N C E N T R AT E E D I B L E S & W E L L N E S S F L O W E R S O L V E N T L E S S , L I V E R E S I N & C U R E D C A R T R I D G E S , D I S P O S A B L E S & C O N C E N T R A T E S I N F U S E D C H E W S & C H O C O L A T E S T I N C T U R E S & C A P S U L E S Scan to check out the brands now on your phone! https://jushico.com/our - brands Comprehensive Suite of Brands Across Portfolio J U S H I ’ S L E A D I N G O M N I C H A N N E L E X P E R I E N C E 14 P A C K A G E D F L O W E R & P R E - R O L L S P A C K A G E D F L O W E R P A C K A G E D F L O W E R & B L U N T S

Markets Regulatory Updates Pennsylvania • • Governor Shapiro, in his annual budget speech, stressed the urgency to establish PA’s adult - use market. (9) Currently, there is a bipartisan bill in the PA Senate that would put into place a commercial adult - use program. (10) Virginia • Commercial adult - use sales bill is on Governor Youngkin’s desk. (11) • Governor Youngkin must take action by April 8, 2024, at 11:59pm or bill will become law. (12) Ohio • Preliminary regs have been published by the Ohio regulator for review. (13) • Adult - use sales expected to begin around September 2024. (13) 15

Appendix

Jushi Leadership Team Jim Cacioppo CEO, Chairman & Founder Jon Barack President & Founder Michelle Mosier Chief Financial Officer Tobi Lebowitz Chief Legal Officer & Corporate Secretary 17

Wholesale Opportunities I n c r e a s i n g R e v e n u e s a n d I m p r o v i n g M a r g i n s Growing wholesale operations and increasing sell - through of Jushi - branded products in our five vertical 36.1% 50.4% $23.2 $30.1 markets US$ Millions + 30% Wholesale Revenue Sell - through of Jushi - branded products in our five vertical markets FY 2023 FY 2022 FY 2022 FY 2023 +14.3 percentage points 18

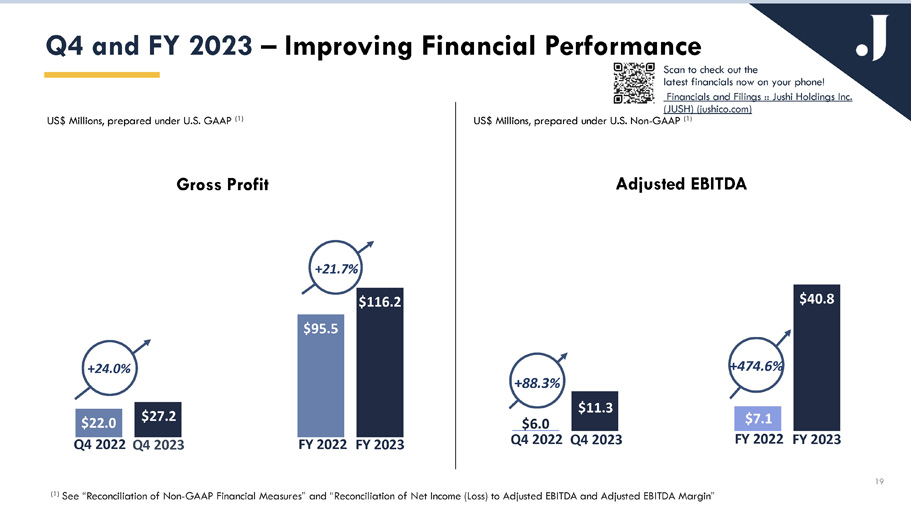

$7.1 $6.0 $11.3 $40.8 Q4 and FY 2023 – Improving Financial Performance 19 US$ Millions, prepared under U.S. GAAP (1) $22.0 $95.5 $27.2 $116.2 Gross Profit Adjusted EBITDA + 474.6% Q4 2022 Q4 2023 + 24.0% Scan to check out the latest financials now on your phone! Financials and Filings :: Jushi Holdings Inc. (JUSH) (jushico.com) US$ Millions, prepared under U.S. Non - GAAP (1) (1) See “Reconciliation of Non - GAAP Financial Measures” and “Reconciliation of Net Income (Loss) to Adjusted EBITDA and Adjusted EBITDA Margin” FY 2022 FY 2023 Q4 2022 Q4 2023 + 88.3% FY 2022 FY 2023 + 21.7%

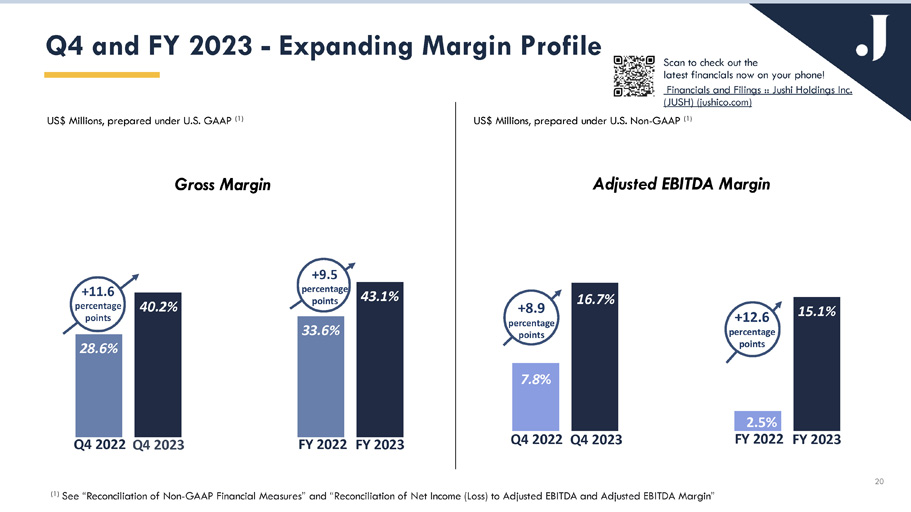

7.8 % 2.5% 16.7% 15.1% Q4 and FY 2023 - Expanding Margin Profile 20 US$ Millions, prepared under U.S. GAAP (1) 28.6% 33.6% 40.2% 43.1% Gross Margin Adjusted EBITDA Margin +12.6 percentage points Scan to check out the latest financials now on your phone! Financials and Filings :: Jushi Holdings Inc. (JUSH) (jushico.com) Q4 2022 Q4 2023 +11.6 percentage points (1) See “Reconciliation of Non - GAAP Financial Measures” and “Reconciliation of Net Income (Loss) to Adjusted EBITDA and Adjusted EBITDA Margin” US$ Millions, prepared under U.S. Non - GAAP (1) FY 2022 FY 2023 Q4 2022 Q4 2023 +8.9 percentage points FY 2022 FY 2023 +9.5 percentage points

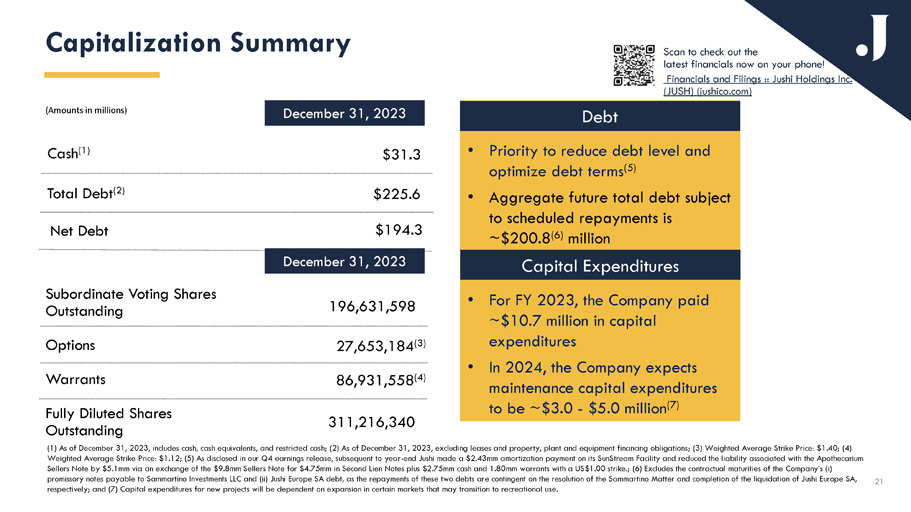

Capitalization Summary (1) As of December 31, 2023, includes cash, cash equivalents, and restricted cash; (2) As of December 31, 2023, excluding leases and property, plant and equipment financing obligations; (3) Weighted Average Strike Price: $1.40; (4) Weighted Average Strike Price: $1.12; (5) As disclosed in our Q4 earnings release, subsequent to year - end Jushi made a $2.43mm amortization payment on its SunStream Facility and reduced the liability associated with the Apothecarium Sellers Note by $5.1mm via an exchange of the $9.8mm Sellers Note for $4.75mm in Second Lien Notes plus $2.75mm cash and 1.80mm warrants with a US$1.00 strike.; (6) Excludes the contractual maturities of the Company’s (i) promissory notes payable to Sammartino Investments LLC and (ii) Jushi Europe SA debt, as the repayments of these two debts are contingent on the resolution of the Sammartino Matter and completion of the liquidation of Jushi Europe SA, respectively; and (7) Capital expenditures for new projects will be dependent on expansion in certain markets that may transition to recreational use. (Amounts in millions) Fully Diluted Shares Outstanding $31.3 Cash (1) $225.6 Total Debt (2) $194.3 December 31, 2023 Net Debt 196,631,598 Subordinate Voting Shares Outstanding 27,653,184 (3) Options 86,931,558 (4) Warrants December 31, 2023 311,216,340 :21 Scan to check out the latest financials now on your phone! Financials and Filings :: Jushi Holdings Inc. (JUSH) (jushico.com) Debt • Priority to reduce debt level and optimize debt terms (5) • Aggregate future total debt subject to scheduled repayments is ~$200.8 (6) million Capital Expenditures • For FY 2023, the Company paid ~$10.7 million in capital expenditures • In 2024, the Company expects maintenance capital expenditures to be ~$3.0 - $5.0 million (7)

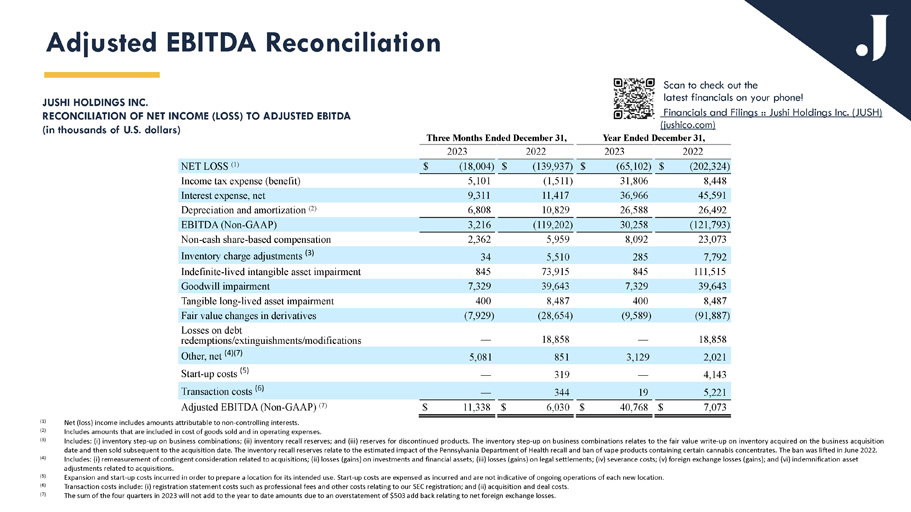

JUSHI HOLDINGS INC. RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA (in thousands of U.S. dollars) Adjusted EBITDA Reconciliation 22 Scan to check out the latest financials on your phone! Financials and Filings :: Jushi Holdings Inc. (JUSH) (jushico.com) Year Ended December 31, Net (loss) income includes amounts attributable to non - controlling interests. (1) Includes amounts that are included in cost of goods sold and in operating expenses. (2) Includes: (i) inventory step - up on business combinations; (ii) inventory recall reserves; and (iii) reserves for discontinued products. The inventory step - up on business combinations relates to the fair value write - up on inventory acquired on the business acquisition date and then sold subsequent to the acquisition date. The inventory recall reserves relate to the estimated impact of the Pennsylvania Department of Health recall and ban of vape products containing certain cannabis concentrates. The ban was lifted in June 2022. (3) Includes: (i) remeasurement of contingent consideration related to acquisitions; (ii) losses (gains) on investments and financial assets; (iii) losses (gains) on legal settlements; (iv) severance costs; (v) foreign exchange losses (gains); and (vi) indemnification asset adjustments related to acquisitions. (4) Expansion and start - up costs incurred in order to prepare a location for its intended use. Start - up costs are expensed as incurred and are not indicative of ongoing operations of each new location. (5) Transaction costs include: (i) registration statement costs such as professional fees and other costs relating to our SEC registration; and (ii) acquisition and deal costs. (6) The sum of the four quarters in 2023 will not add to the year to date amounts due to an overstatement of $503 add back relating to net foreign exchange losses. (7) Three Months Ended December 31, 2022 2023 2022 2023 $ (202,324) $ (65,102) $ (139,937) $ (18,004) NET LOSS (1) 8,448 31,806 (1,511) 5,101 Income tax expense (benefit) 45,591 36,966 11,417 9,311 Interest expense, net 26,492 26,588 10,829 6,808 Depreciation and amortization (2) (121,793) 30,258 (119,202) 3,216 EBITDA (Non - GAAP) 23,073 8,092 5,959 2,362 Non - cash share - based compensation 7,792 285 5,510 34 Inventory charge adjustments (3) 111,515 845 73,915 845 Indefinite - lived intangible asset impairment 39,643 7,329 39,643 7,329 Goodwill impairment 8,487 400 8,487 400 Tangible long - lived asset impairment (91,887) (9,589) (28,654) (7,929) Fair value changes in derivatives 18,858 — 18,858 — Losses on debt redemptions/extinguishments/modifications 2,021 3,129 851 5,081 Other, net (4)(7) 4,143 — 319 — Start - up costs (5) 5,221 19 344 — Transaction costs (6) $ 7,073 $ 40,768 $ 6,030 $ 11,338 Adjusted EBITDA (Non - GAAP) (7)

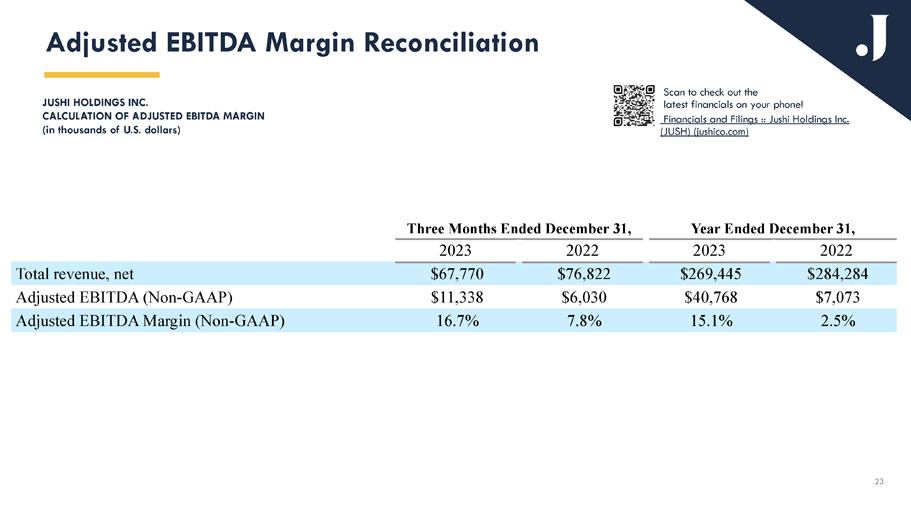

JUSHI HOLDINGS INC. CALCULATION OF ADJUSTED EBITDA MARGIN (in thousands of U.S. dollars) Adjusted EBITDA Margin Reconciliation 23 Scan to check out the latest financials on your phone! Financials and Filings :: Jushi Holdings Inc. (JUSH) (jushico.com) Three Months Ended December 31, Year Ended December 31, 2022 2023 2022 2023 $284,284 $269,445 $76,822 $67,770 Total revenue, net $7,073 $40,768 $6,030 $11,338 Adjusted EBITDA (Non - GAAP) 2.5% 15.1% 7.8% 16.7% Adjusted EBITDA Margin (Non - GAAP)

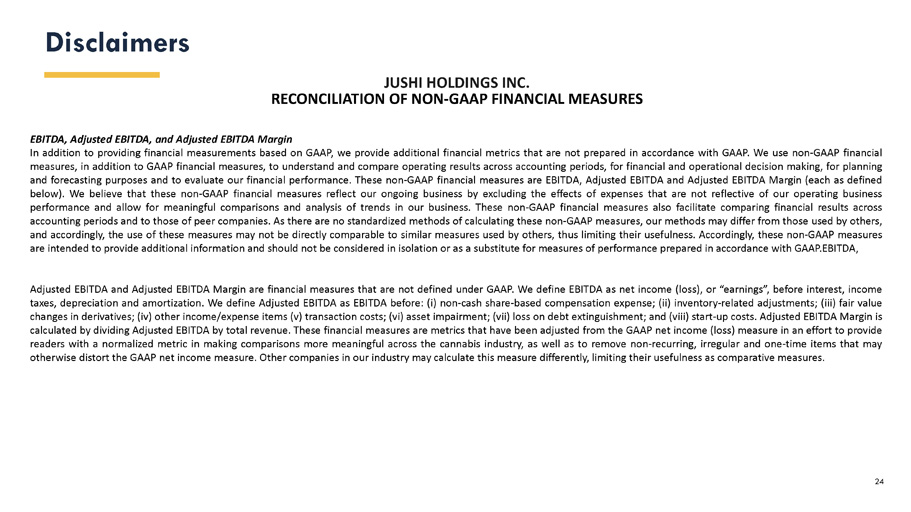

Disclaimers 24 JUSHI HOLDINGS INC. RECONCILIATION OF NON - GAAP FINANCIAL MEASURES EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin In addition to providing financial measurements based on GAAP, we provide additional financial metrics that are not prepared in accordance with GAAP . We use non - GAAP financial measures, in addition to GAAP financial measures, to understand and compare operating results across accounting periods, for financial and operational decision making, for planning and forecasting purposes and to evaluate our financial performance . These non - GAAP financial measures are EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin (each as defined below) . We believe that these non - GAAP financial measures reflect our ongoing business by excluding the effects of expenses that are not reflective of our operating business performance and allow for meaningful comparisons and analysis of trends in our business . These non - GAAP financial measures also facilitate comparing financial results across accounting periods and to those of peer companies . As there are no standardized methods of calculating these non - GAAP measures, our methods may differ from those used by others, and accordingly, the use of these measures may not be directly comparable to similar measures used by others, thus limiting their usefulness . Accordingly, these non - GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP . EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are financial measures that are not defined under GAAP . We define EBITDA as net income (loss), or “earnings”, before interest, income taxes, depreciation and amortization . We define Adjusted EBITDA as EBITDA before : (i) non - cash share - based compensation expense ; (ii) inventory - related adjustments ; (iii) fair value changes in derivatives ; (iv) other income/expense items (v) transaction costs ; (vi) asset impairment ; (vii) loss on debt extinguishment ; and (viii) start - up costs . Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by total revenue . These financial measures are metrics that have been adjusted from the GAAP net income (loss) measure in an effort to provide readers with a normalized metric in making comparisons more meaningful across the cannabis industry, as well as to remove non - recurring, irregular and one - time items that may otherwise distort the GAAP net income measure . Other companies in our industry may calculate this measure differently, limiting their usefulness as comparative measures .

NO OFFERS This presentation does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of securities of the Company in any jurisdiction in which an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction . THIRD PARTY INFORMATION This presentation may include market and industry data which was obtained from various publicly available sources and other sources believed by the Company to be true . Although the Company believes it to be reliable, the Company has not independently verified any of the data from third - party sources referred to in this presentation or analyzed or verified the underlying reports relied upon or referred to by such sources, or ascertained the underlying assumptions relied upon by such sources . The Company does not make any representation as to the accuracy of such information . REGULATORY Potential investors are aware that the cannabis market is highly regulated, and that various permits and authorizations are necessary for the import, distribution, sale or other business activities related to medicinal cannabis . The respective regulations can be subject to change, which might affect the permits required . This presentation does not intend to advertise the products of the Company . Any reference to the products serves only the information of potential investors and shall not incite the purchase of the products . COPYRIGHT All brands and trademarks mentioned in this presentation and possibly protected by third parties are subject without restriction to the provisions of the applicable trademark law and the ownership rights of the respective registered owners . The mere fact that a trademark is mentioned should not lead to the conclusion that it is not protected by the rights of third parties . The copyright for published objects created by the Company remains solely with the Company . Any duplication or use of objects such as diagrams, sounds or texts in other electronic or printed publications is not permitted without the Company's agreement . CURRENCY All references to $ or “dollar” in this presentation are references to USD, unless otherwise indicated . Disclaimers 25

Endnotes • • • • • (1) (Number of Pennsylvania dispensaries) https: //www.health.pa.gov/topics/Documents/Programs/Medical%20Marijuana/MMAB%20Program%20Update%20Data - Nov%2015,%202023.pdf (2) (Population) https: //www.census.gov/quickfacts/PA (3) (4) (Pennsylvania Patients & Caregivers and Active Patients) https://www.health.pa.gov/topics/Documents/Programs/Medical%20Marijuana/MMAB%20Program%20Update%20Data%20 - %20Sept%206%202023.pdf and https://www.health.pa.gov/topics/Documents/Programs/Medical%20Marijuana/MMAB%20Program%20Update%20Data%E2%80%94Jan%2024,%2020 24. pdf (5) (Virginia State Population) https://www.census.gov/quickfacts/VA (6) (Health Service Area (“HAS”) II Population) https://www.census.gov/quickfacts/alexandriacityvirginia ; https://www.census.gov/quickfacts/fact/table/fairfaxcountyvirginia,fairfaxcityvirginia,arlingtoncountyvirginia,alexandriacity vir ginia/PST045222 ; https://www.census.gov/quickfacts/fact/table/princewilliamcountyvirginia,manassascityvirginia,loudouncountyvirginia,fairfaxco unt yvirginia,arlingtoncountyvirginia,alexandriacityvirginia/PST045222 (7) (Jushi’s total number of unique patient visits in Jushi’s HSA II footprint since March 1, 2024). Total number of unique individuals to visit Jushi dispensaries since the beginning of a medical program within HSA II". Virginia does not provide state level patient counts. (8) Data is sourced from Springbig which doesn’t include PA and MA data app users (9) (Governor Shapiro‘s 2024 - 2025 budget proposal supporting an adult - use market) - https://www.governor.pa.gov/newsroom/governor - shapiro - unveils - 2024 - 25 - budget - proposal - to - get - stuff - done - create - opportunity - and - advance - real - freedom - for - all - pennsylvanians (9) (Governor Shapiro calls for an adult - use bill sent to him) https: //www.cbsnews.com/pittsburgh/news/pennsylvania - governor - josh - shapiro - calls - legalization - recreational - marijuana/ (10)(Senate Bill 846) btCheck.cfm (state.pa.us) (16) (Virginia election results) Beacon Securities Marijuana Industry Update Research Report published November 13, 2023 (11) (Virginia legislature (House and Senate) passed a marijuana sales bill) Virginia Legislature Passes Marijuana Sales Bill, Sending Proposal To Governor's Desk - Marijuana Moment (12) (Virginia Governor’s potential next steps) https: //www.wbtmdanville.com/2024/03/11/virginia - lawmakers - approve - budget - but - governor - warns - that - changes - will - be - needed/ (13) (Ohio statue passing and % of votes) Canaccord Genuity Capital Markets Industry Update Equity Research Report published November 8, 2023 (13) (Ohio Statue 2 adult - use cannabis program details) Full - Text - of - the - Law.pdf (justlikealcohol.com) • • • • • • • • • • 26

Thank Y ou Contact investors@jushico.com