Exhibit 99.2

Jushi Holdings Inc. Q2 2022 Earnings Presentation

Cautionary Statement Regarding Forward - Looking Statements 2 This presentation contains certain "forward - looking information" within the meaning of applicable Canadian securities legislation as well as statements that may constitute "forward - looking statements" within the meaning of within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements, other than statements of historical facts, contained in this presentation, including statements regarding our strategy, future operations, intended expansion of our retail operations and production capacity, intended expansion of our cultivation facilities, future financial position, projected costs, prospects, plans and objectives of management, including without limitation Q 4 2022 annualized guidance, are forward - looking statements . These forward - looking statements are based on Jushi’s current expectations and beliefs concerning future developments and their potential effects . As a result, actual results could differ materially from those expressed by such forward - looking statements and such statements should not be relied upon . Generally, such forward - looking information or forward - looking statements can be identified by the use of forward - looking terminology such as “plans,” “expects” or “does not expect,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates” or “does not anticipate,” or “believes,” or variations of such words and phrases or may contain statements that certain actions, events or results “may,” “could,” “would,” “might” or “will be taken,” “will continue,” “will occur” or “will be achieved” . The forward - looking information and forward - looking statements contained herein may include but are not limited to, information concerning the expectations regarding Jushi, or the ability of Jushi to successfully achieve business objectives, and expectations for other economic, business, and/or competitive factors . Many factors could cause actual future events to differ materially from the forward - looking statements in this presentation, including risks related to the ability of Jushi to successfully and/or timely achieve business objectives, including with regulatory bodies, employees, suppliers, customers and competitors ; changes in general economic, business and political conditions, including changes in the financial markets ; changes in applicable laws ; and compliance with extensive government regulation, as well as other risks, uncertainties and other cautionary statements in the Company’s public filings with the applicable securities regulatory authorities on the SEC’s website at www . sec . gov and on SEDAR at www . sedar . com . Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward - looking information or statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated, or expected . Although the Company believes that the assumptions and factors used in preparing, and the expectations contained in, the forward - looking information and statements are reasonable, undue reliance should not be placed on such information and statements, and no assurance or guarantee can be given that such forward - looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information and statements . The forward - looking information and forward - looking statements contained in this presentation are made as of the date of this presentation, and the Company does not undertake to update any forward - looking information and/or forward - looking statements that are contained or referenced herein, except in accordance with applicable securities laws . All subsequent written and oral forward - looking information and statements attributable to the Company or persons acting on its behalf is expressly qualified in its entirety by this notice .

Jim Cacioppo Chief Executive Officer

Financial Highlights Operational Achievements Financial Performance Agenda Outlook Q&A 4

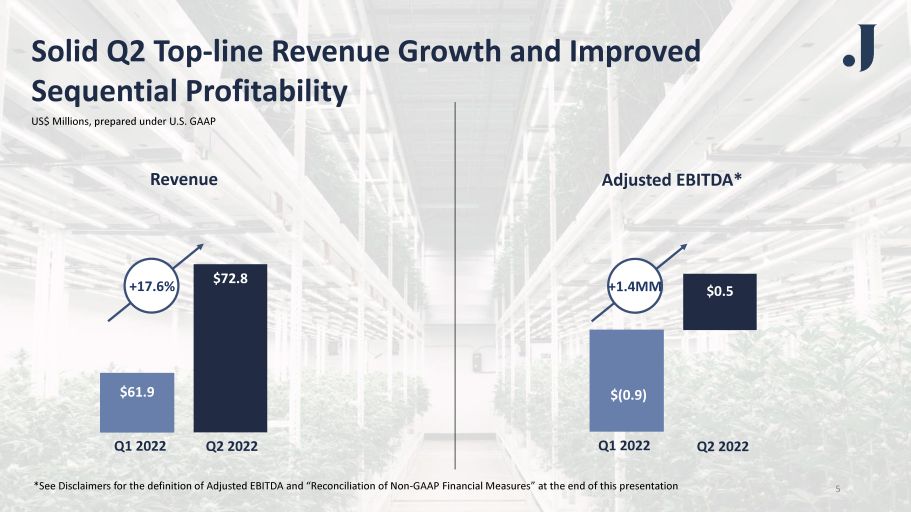

Solid Q2 Top - line Revenue Growth and Improved Sequential Profitability US$ Millions, prepared under U.S. GAAP 5 $61.9 $72.8 +17.6% Q2 2022 Q1 2022 Revenue *See Disclaimers for the definition of Adjusted EBITDA and “Reconciliation of Non - GAAP Financial Measures” at the end of this pr esentation $(0.9) $0.5 Adjusted EBITDA* Q2 2022 Q1 2022 +1.4MM

Improved Sell - Through Rate of Jushi Branded Product 6 • Significant profitability driver in the coming quarters • Sell - through rate improvement of 770 basis points to 21% vs. 14% in Q1 2022 • Flower and vape products in Pennsylvania reaching 40% of weekly sold units Jushi Brand Penetration

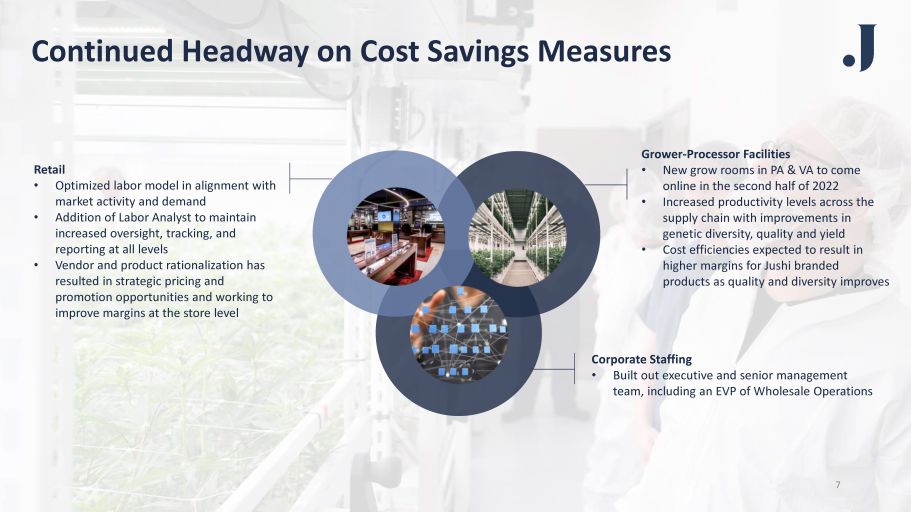

Continued Headway on Cost Savings Measures Retail • Optimized labor model in alignment with market activity and demand • Addition of Labor Analyst to maintain increased oversight, tracking, and reporting at all levels • Vendor and product rationalization has resulted in strategic pricing and promotion opportunities and working to improve margins at the store level Grower - Processor Facilities • New grow rooms in PA & VA to come online in the second half of 2022 • Increased productivity levels across the supply chain with improvements in genetic diversity, quality and yield • Cost efficiencies expected to result in higher margins for Jushi branded products as quality and diversity improves Corporate Staffing • Built out executive and senior management team, including an EVP of Wholesale Operations 7

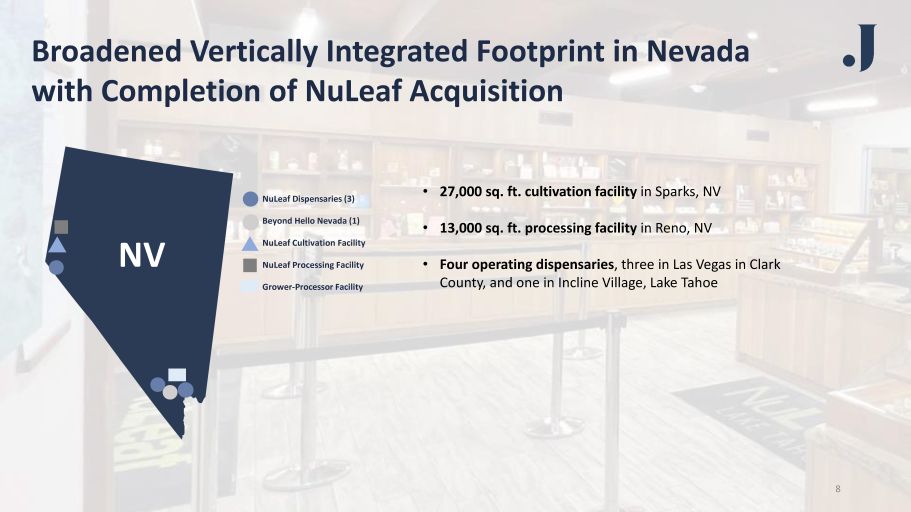

Broadened Vertically Integrated Footprint in Nevada with Completion of NuLeaf Acquisition • 27,000 sq. ft. cultivation facility in Sparks, NV • 13,000 sq. ft. processing facility in Reno, NV • Four operating dispensaries , three in Las Vegas in Clark County, and one in Incline Village, Lake Tahoe NuLeaf Dispensaries (3) Beyond Hello Nevada (1) NuLeaf Cultivation Facility NuLeaf Processing Facility Grower - Processor Facility NV 8

Scranton, PA Grower - Processor Phase 1 of Cultivation Expansion Completed: VA & PA Expansion Projects Manassas, VA Grower - Processor 9

Scranton, PA 10

Manassas, VA Lakeville, MA Alexandria, VA

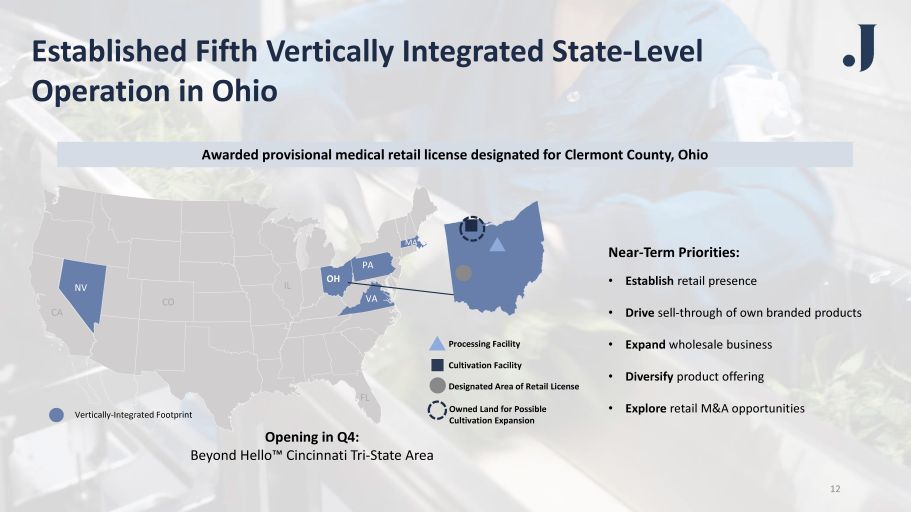

Established Fifth Vertically Integrated State - Level Operation in Ohio 12 PA Verticall y - Integrated Footprint CA NV CO IL OH PA VA FL M A Processing Facility Cultivation Facility Designated Area of Retail License Owned Land for Possible Cultivation Expansion Opening in Q4: Beyond Hello Ρ Cincinnati Tri - State Area Near - Term Priorities: • Establish retail presence • Drive sell - through of own branded products • Expand wholesale business • Diversify product offering • Explore retail M&A opportunities Awarded provisional medical retail license designated for Clermont County, Ohio

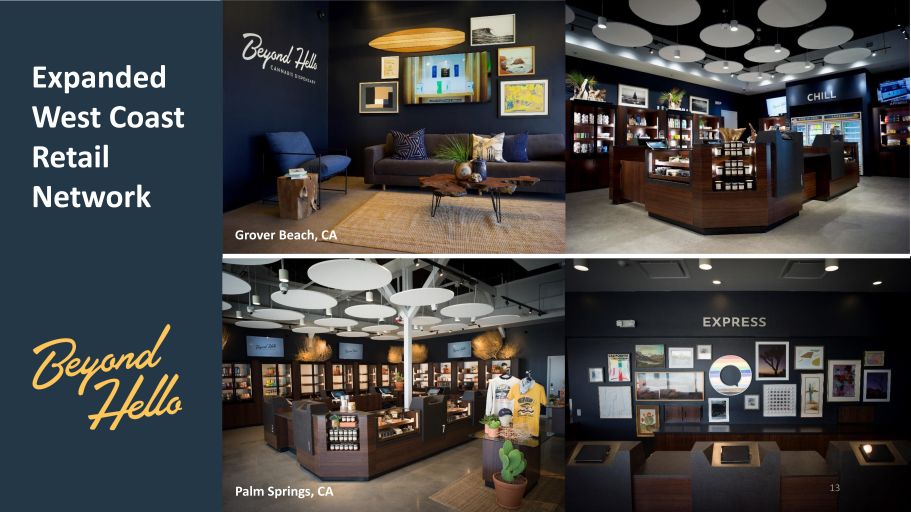

13 Expanded West Coast Retail Network Palm Springs, CA Grover Beach, CA Alexandria, VA Palm Springs, CA 13

Debuted Two New Innovative Product Lines Live Resin & Live Rosin Extract Products Now Available in PA Coming Soon to MA, NV, & VA More differentiated products coming to select markets in H2 2022 and 2023 14 Now Available in NV, OH, & VA Coming Soon to MA

Jon Barack President, Interim Chief Financial Officer 15

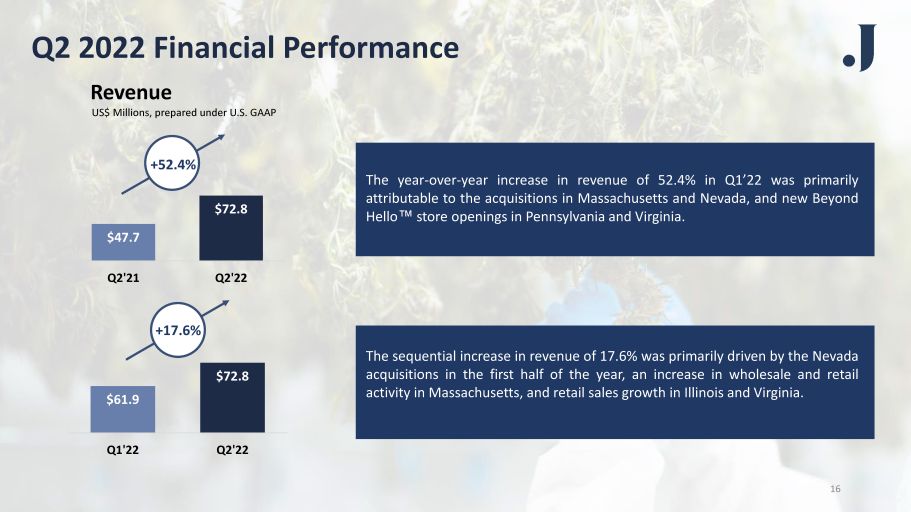

Q2 2022 Financial Performance $ 61.9 $72.8 Q1'22 Q2'22 Revenue $47.7 $ 72.8 Q2'21 Q2'22 +52.4% US$ Millions, prepared under U.S. GAAP The year - over - year increase in revenue of 52 . 4 % in Q 1 ’ 22 was primarily attributable to the acquisitions in Massachusetts and Nevada, and new Beyond Hello Œ store openings in Pennsylvania and Virginia . The sequential increase in revenue of 17 . 6 % was primarily driven by the Nevada acquisitions in the first half of the year, an increase in wholesale and retail activity in Massachusetts, and retail sales growth in Illinois and Virginia . +17.6 % 16

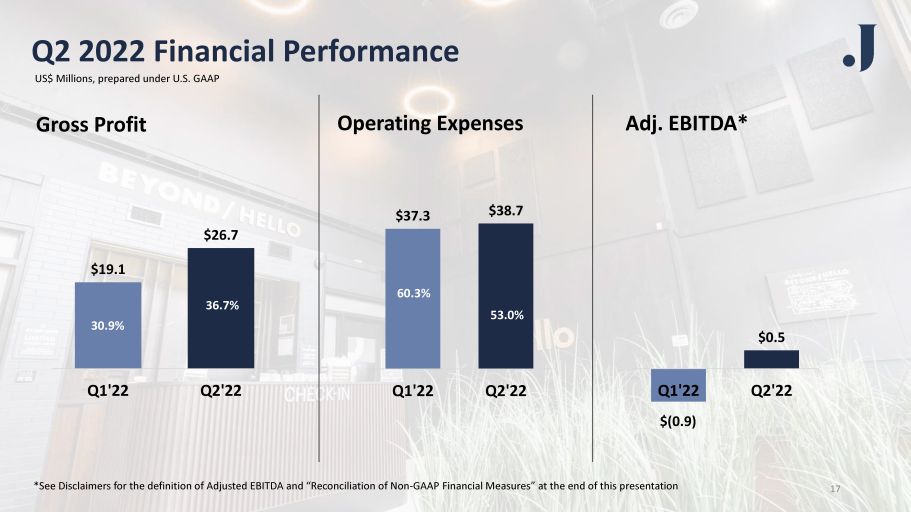

Q2 2022 Financial Performance $19.1 $26.7 Q1'22 Q2'22 Gross Profit $37.3 $38.7 Q1'22 Q2'22 Operating Expenses $(0.9) $0.5 Q1'22 Q2'22 Adj. EBITDA* 30.9% 36.7% US$ Millions, prepared under U.S. GAAP 53.0% 60.3% 17 *See Disclaimers for the definition of Adjusted EBITDA and “Reconciliation of Non - GAAP Financial Measures” at the end of this pr esentation

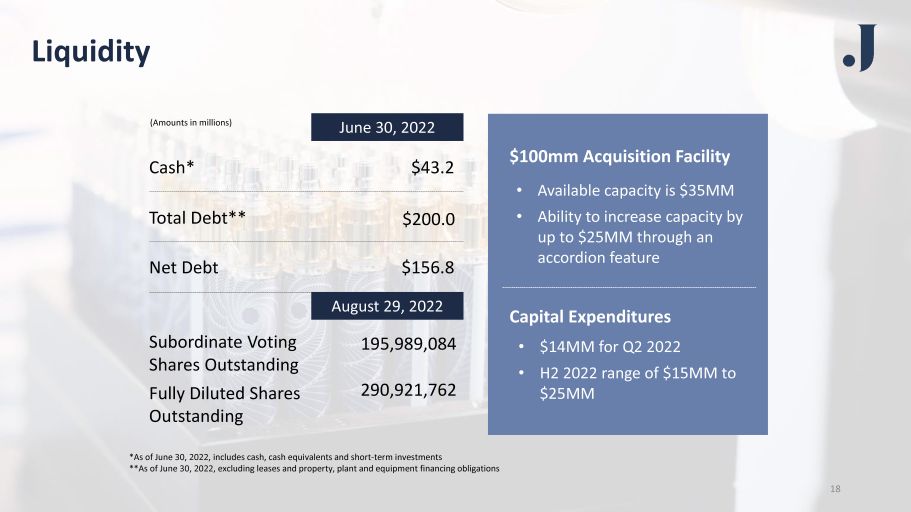

Liquidity *A s of June 30, 2022, includes cash, cash equivalents and short - term investments **As of June 30 , 2022 , excluding leases and property, plant and equipment financing obligations (Amounts in millions) $100mm Acquisition Facility • Available capacity is $35MM • Ability to increase capacity by up to $25MM through an accordion feature Capital Expenditures • $14MM for Q2 2022 • H2 2022 range of $15MM to $25MM Cash* Total Debt** Net Debt Subordinate Voting Shares Outstanding Fully Diluted Shares Outstanding $43.2 $200.0 $156.8 195,989,084 290,921,762 August 29, 2022 June 30, 2022 18

Outlook

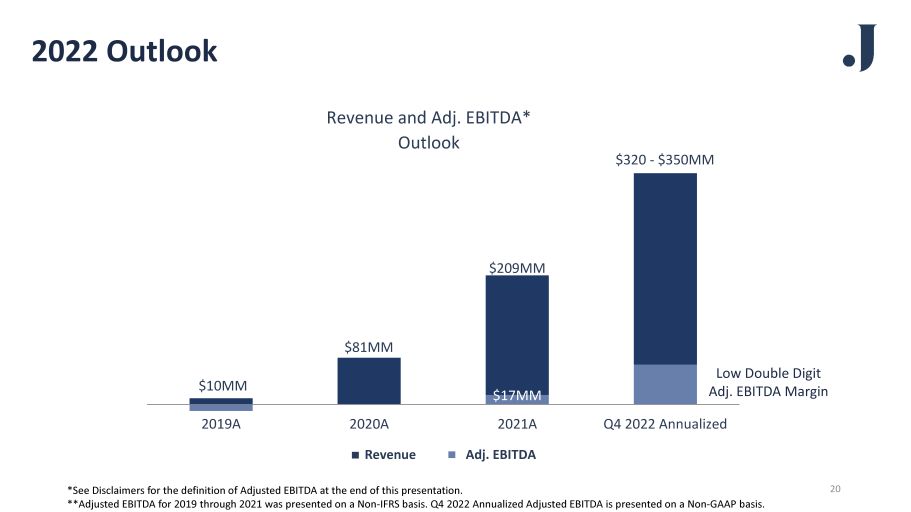

Revenue and Adj. EBITDA* Outlook $17MM $10MM $81MM $209MM $320 - $350MM 2019A 2020A 2021A Q4 2022 Annualized Revenue Adj. EBITDA *See Disclaimers for the definition of Adjusted EBITDA at the end of this presentation. **Adjusted EBITDA for 2019 through 2021 was presented on a Non - IFRS basis. Q4 2022 Annualized Adjusted EBITDA is presented on a Non - GAAP basis. 2022 Outlook 20 Low Double Digit Adj. EBITDA Margin

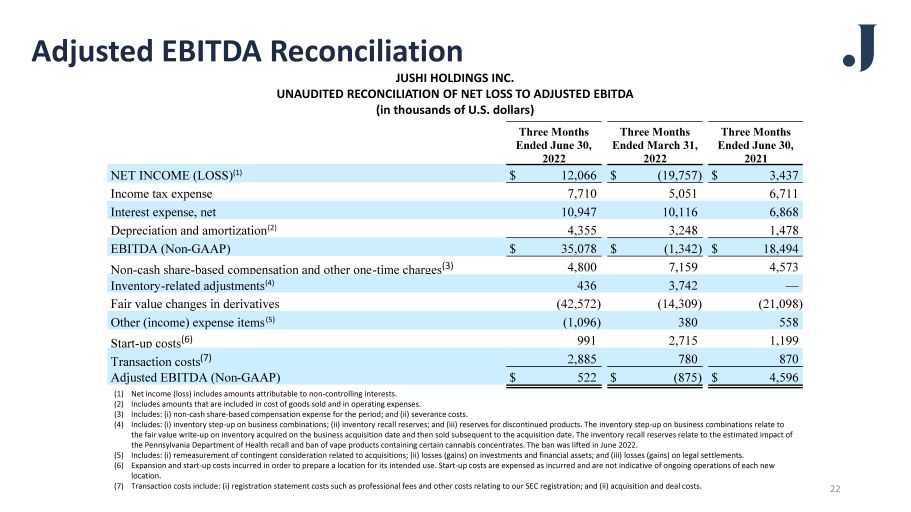

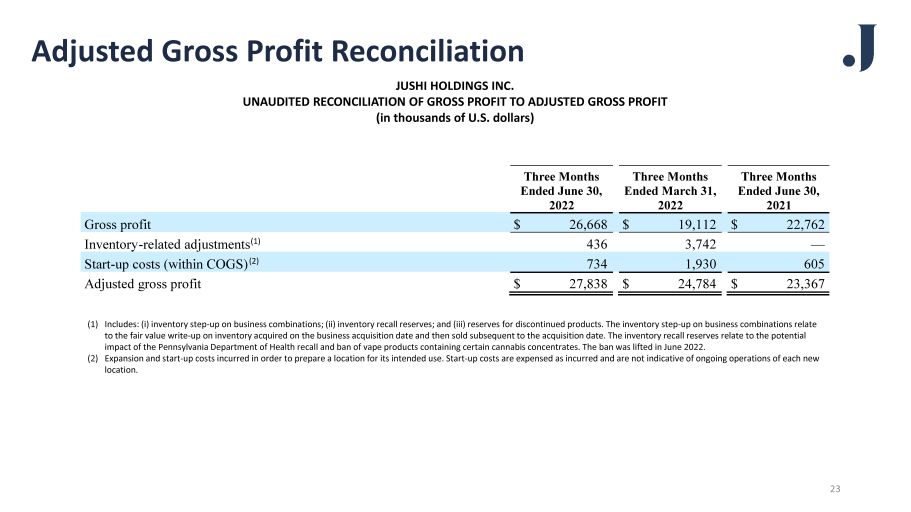

Disclaimers JUSHI HOLDINGS INC. Reconciliation of Non - GAAP Financial Measures EBITDA, Adjusted EBITDA and Adjusted Gross Profit In addition to providing financial measurements based on GAAP, the Company provides additional financial metrics that are not prepared in accordance with GAAP . Management uses non - GAAP financial measures, in addition to GAAP financial measures, to understand and compare operating results across accounting periods, for financial and operational decision making, for planning and forecasting purposes and to evaluate the Company’s financial performance . These non - GAAP financial measures are EBITDA, Adjusted EBITDA and Adjusted Gross Profit (defined below) . Management believes that these non - GAAP financial measures reflect the Company’s ongoing business in a manner that allows for meaningful comparisons and analysis of trends in the business, as they facilitate comparing financial results across accounting periods and to those of peer companies . As there are no standardized methods of calculating these non - GAAP measures, the Company’s methods may differ from those used by others, and accordingly, the use of these measures may not be directly comparable to similar measures used by others, thus limiting their usefulness . Accordingly, these non - GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP . EBITDA, Adjusted EBITDA and Adjusted Gross Profit are financial measures that are not defined under GAAP . Management defines EBITDA as net income (loss), or “earnings”, before interest, income taxes, depreciation and amortization . Management defines Adjusted EBITDA as EBITDA before : ( i ) non - cash share - based compensation expense and other one - time charges ; (ii) inventory - related adjustments ; (iii) fair value changes in derivatives ; (iv) other income/expense items (v) transaction costs ; and (vi) start - up costs . These financial measures are metrics that have been adjusted from the GAAP net income (loss) measure in an effort to provide readers with a normalized metric in making comparisons more meaningful across the cannabis industry, as well as to remove non - recurring, irregular and one - time items that may otherwise distort the GAAP net income measure . Other companies in the Corporation’s industry may calculate this measure differently, limiting their usefulness as comparative measures . Management defines Adjusted Gross Profit as gross profit, as reported, adjusted to exclude certain inventory - related adjustments and start - up costs (within cost of goods sold) . 21

Adjusted EBITDA Reconciliation 22 (1) Net income (loss) includes amounts attributable to non - controlling interests. (2) Includes amounts that are included in cost of goods sold and in operating expenses. (3) Includes: ( i ) non - cash share - based compensation expense for the period; and (ii) severance costs. (4) Includes: ( i ) inventory step - up on business combinations; (ii) inventory recall reserves; and (iii) reserves for discontinued products. The inventory step - up on business combinations relate to the fair value write - up on inventory acquired on the business acquisition date and then sold subsequent to the acquisition date. The inventory recall reserves relate to the estimated impact of the Pennsylvania Department of Health recall and ban of vape products containing certain cannabis concentrates. The ban was l ift ed in June 2022. (5) Includes: ( i ) remeasurement of contingent consideration related to acquisitions; (ii) losses (gains) on investments and financial assets; an d (iii) losses (gains) on legal settlements. (6) Expansion and start - up costs incurred in order to prepare a location for its intended use. Start - up costs are expensed as incurr ed and are not indicative of ongoing operations of each new location. (7) Transaction costs include: ( i ) registration statement costs such as professional fees and other costs relating to our SEC registration; and (ii) acquisiti on and deal costs. JUSHI HOLDINGS INC. UNAUDITED RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA (in thousands of U.S. dollars) Three Months Ended June 30, 2022 Three Months Ended March 31, 2022 Three Months Ended June 30, 2021 NET INCOME (LOSS) (1) $ 12,066 $ (19,757) $ 3,437 Income tax expense 7,710 5,051 6,711 Interest expense, net 10,947 10,116 6,868 Depreciation and amortization (2) 4,355 3,248 1,478 EBITDA (Non-GAAP) $ 35,078 $ (1,342) $ 18,494 Non-cash share-based compensation and other one-time charges (3) 4,800 7,159 4,573 Inventory-related adjustments (4) 436 3,742 — Fair value changes in derivatives (42,572) (14,309) (21,098) Other (income) expense items (5) (1,096) 380 558 Start-up costs (6) 991 2,715 1,199 Transaction costs (7) 2,885 780 870 Adjusted EBITDA (Non-GAAP) $ 522 $ (875) $ 4,596

Adjusted Gross Profit Reconciliation 23 (1) Includes: ( i ) inventory step - up on business combinations; (ii) inventory recall reserves; and (iii) reserves for discontinued products. The inventory step - up on business combinations relate to the fair value write - up on inventory acquired on the business acquisition date and then sold subsequent to the acquisition da te. The inventory recall reserves relate to the potential impact of the Pennsylvania Department of Health recall and ban of vape products containing certain cannabis concentrates. The ba n was lifted in June 2022. (2) Expansion and start - up costs incurred in order to prepare a location for its intended use. Start - up costs are expensed as incurr ed and are not indicative of ongoing operations of each new location. JUSHI HOLDINGS INC. UNAUDITED RECONCILIATION OF GROSS PROFIT TO ADJUSTED GROSS PROFIT (in thousands of U.S. dollars) Three Months Ended June 30, 2022 Three Months Ended March 31, 2022 Three Months Ended June 30, 2021 Gross profit $ 26,668 $ 19,112 $ 22,762 Inventory-related adjustments (1) 436 3,742 — Start-up costs (within COGS) (2) 734 1,930 605 Adjusted gross profit $ 27,838 $ 24,784 $ 23,367

Q&A

Disclaimers NO OFFERS This presentation does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of securities of the Company in any jurisdiction in which an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction . The securities of the Company described herein have not been and will not be registered under the United States federal or state securities laws and may not be offered or sold in the United States, or to, or for the account or benefit of,

“U . S . Persons” as such term is defined in Regulation S under the United States Securities Act of 1933 , as amended (the “U . S . Securities Act”), unless an exemption from registration is available . Prospective investors will be required to represent, among other things, that they meet the requirements of an available exemption from the registration requirements of the U . S . Securities Act and are familiar with and understand the terms of the offering and have all requisite authority to make such investment . IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE COMPANY AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED . THE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR BY ANY STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY, NOR HAVE ANY OF THE FOREGOING AUTHORITIES OR ANY CANADIAN PROVINCIAL SECURITIES REGULATOR PASSED ON THE ACCURACY OR ADEQUACY OF THIS PRESENTATION . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . THIRD PARTY INFORMATION This presentation may include market and industry data which was obtained from various publicly available sources and other sources believed by the Company to be true . Although the Company believes it to be reliable, the Company has not independently verified any of the data from third - party sources referred to in this presentation or analyzed or verified the underlying reports relied upon or referred to by such sources, or ascertained the underlying assumptions relied upon by such sources . The Company does not make any representation as to the accuracy of such information . TARGET AUDIENCE This presentation is only addressed to those persons, which have been explicitly determined by the Company as recipients . The Company did not and will not authorize any third parties to distribute this presentation or make it available to persons not determined by the Company or to the public . Any unauthorized distribution or disclosure will constitute an infringement of the concluded non - disclosure agreement and the Company reserves the right to take further legal action in such cases . No action has been (or will be) taken by the Company that would permit the possession or distribution of this presentation . Persons into whose possession this presentation may come are required to inform themselves of and observe any corresponding restrictions . The Company does not accept any responsibility for any violation by any person of any such restrictions . REGULATORY Potential investors are aware that the cannabis market is highly regulated, and that various permits and authorizations are n ece ssary for the import, distribution, sale or other business activities related to medicinal cannabis. The respective regulations can be subject to change, which might affect the permits required. This presentation does not intend t o a dvertise the products of the Company. Any reference to the products serves only the information of potential investors and shall not incite the purchase of the products. TAXATION Prospective investors should be aware that the purchase of securities of the Company or any entity related thereto may have t ax consequences both in Canada and the United States. Each prospective investor is strongly encouraged to consult its own tax advisor concerning any purchase of securities of the Company or any entity related thereto and the holdin g a nd disposition of any such securities. This presentation does not address the tax consequences of the purchase, ownership or disposition of any such securities. COPYRIGHT All brands and trademarks mentioned in this presentation and possibly protected by third parties are subject without restrict ion to the provisions of the applicable trademark law and the ownership rights of the respective registered owners. The mere fact that a trademark is mentioned should not lead to the conclusion that it is not protected by the rights of third parties. The copyright for published objects created by the Company remains solely with the Company. Any duplication or use of objects such as diagrams, sounds or texts in other electronic or printed publications is not permit ted without the Company's agreement. CURRENCY All references to $ or “dollar” in this presentation are references to USD, unless otherwise indicated. 25